We’re asking Curve, Convex, StakeDAO, and Yearn Teams to help with a slow rug problem.

As you may know, Curve has only called one Emergency DAO action which caused losses for whales who provided 3CRV liquidity to the USDM pool, as well as significant losses to holders who did not know about this emergency action and became USDM bag holders. The Curve team told Azeem that he needed to do at least two things: create a multisig wallet and form a DAO. From our research, the multisig is faked with his own accounts. The DAO is not formed, there’s no webpage to make proposals to help steer the direction of USDM and Mochi. In fact, Azeem has a habit of blocking people from commenting in the GAIADAO Discord and deleting their comments. This is the opposite of decentralized, community led solutions that Curve advised.

Moreover, let’s add a couple more things to the mix.

Azeem has implemented a 25% management & performance fee which he collects from the 1.1 million Convex tokens that have been locked. Why? In what world does he deserve 25%? Isn’t he also a bag holder, and could earn rewards based on the size of his USDM bag?

These CVX tokens were previously locked in Convex and delegated to Votium / Union, but now are delegated to StakeDAO. He once raised this performance fee to 55% until he was called out and the amount was reduced back down to 25%.

Azeem has threatened that 100% of the rewards of locked Convex tokens will be sold to purchase USDM. I advised him that he could demonstrate pro-social behavior by using his 25% performance / management fee to buy USDM on his own and continue with 75% of the rewards going to USDM stakeholders.

Now it has happened. Azeem has begun his own personal strategy. I’ll detail below with help from Yangu who did this research. We’d like feedback from the four protocol teams about what can be done.

Yangu generated this table: sep_24-25_az_scam_fee.csv

| Column 1 | Column 2 | Column 3 | Column 4 | E | F | G | H | I | J |

|---|---|---|---|---|---|---|---|---|---|

| Tx hash & date | gCRV minted to Safe (big + small) | Small gCRV mint → Safe | gCRV returned by claimer | Total gCRV available (minted + returned) | gCRV sent to claimer | gCRV sent to operator (0xfc6c40…) | Residual gCRV left in Safe | Total withheld (operator + small mint + returned + residual) | Withheld % of total |

| 0x567e27b7… (Aug‑14‑2025) | 0 | 0 | — | 0 (no gCRV minted) | 0 | 1 011.5584 gCRV sent to operator | — | Not a claim; just a redemption swap. | N/A |

| 0xea80d857… (Aug‑08‑2025) | 0 | 0 | — | 0 (no gCRV minted) | 0 | 829.4647 gCRV sent to operator | — | Not a claim; redemption with FXS swap. | N/A |

| 0xaca7bf80… (Jul‑23‑2025) | 45 807.94 | 261.43 | 956.34 | 47 025.71 gCRV | 36 642.61 gCRV sent to claimer | 10 376.33 gCRV | 6.77 gCRV | 11600.87 | 24.67% |

| 0x235bc3b3… (Jun‑25‑2025) | 45 994.10 | 238.46 | 907.17 | 47 139.72 gCRV | 36 779.84 gCRV to claimer | 10 340.19 gCRV | 19.70 gCRV | 11505.51 | 24.41% |

| 0xf548bc9d… (Jun‑11‑2025) | 47 592.23 | 282.64 | 831.53 | 48 706.40 gCRV | 38 068.87 gCRV to claimer | 10 629.67 gCRV | 7.86 gCRV | 11751.7 | 24.13% |

| 0x1718e556… (May‑28‑2025) | 43 708.47 | 404.06 | 808.4 | 44 920.94 gCRV | 34 954.47 gCRV to claimer | 9 950.61 gCRV | 15.86 gCRV | 11178.93 | 24.89% |

| 0x4fd40373… (Jul‑09‑2025) | 53 403.54 | 287.49 | 875.73 | 54 566.76 gCRV | 42 664.50 gCRV to claimer | 11 828.87 gCRV | 73.39 gCRV | 13065.48 | 23.94% |

| 0xf2df6f2e… (May‑2025) | 34 418.73 | 415.45 | 642.92 | 35 477.10 gCRV | 27 506.43 gCRV to claimer | 7 932.34 gCRV | 38.33 gCRV | 9029.04 | 25.45% |

| 0xfd32f170… (14‑May‑2025) | 42 111.21196654214989314 | 454.9956103 | 899.2149169 | 43 465.42 | 33 687.551183759579706968 | 9 773.749911814008187565 | 4.121398186 | 11 132.0818 | 25.61% |

| 0x614ed0d4… (30‑Apr‑2025) | 47 570.875471207207923089 | 413.1274027 | 802.4065748 | 48 786.41 | 38 030.550032434582128213 | 10 722.470390091980897420 | 33.38902609 | 11 971.39 | 24.54% |

| 0x58447dd2… (16‑Apr‑2025) | 42 189.371334810079135598 | 427.2785113 | 867.5817941 | 43 484.23 | 33 700.224126022232246325 | 9 719.207866479046836202 | 64.79964773 | 11 078.8678 | 25.48% |

| 0x6e2c8857… (??‑2025) | 42 410.774414449917288465 | 327.761187 | 666.9898081 | 43 405.53 | 33 903.783204228171644363 | 9 468.691339792302984857 | 33.05086552 | 10 496.4932 | 24.18% |

| 0xe3063a95… (??‑2025) | 35 343.296017588844859136 | 310.7846046 | 647.5040204 | 36 301.58 | 28 264.182400639082172324 | 8 022.550721649484105954 | 14.85152032 | 8 995.6909 | 24.78% |

| 0x97b9bd0f… (??‑2025) | 36 890.470404042721438009 | 346.572379 | 678.0846873 | 37 915.13 | 29 476.893568687451946185 | 8 393.302572816904710898 | 44.93132884 | 9 462.8910 | 24.96% |

| 0x4b2f285c… (19‑Feb‑2025) | 35 302.131538541620539610 | 288.3577982 | 850.803828 | 36 441.29 | 28 221.406329270297748211 | 8 192.510397979791505914 | 27.37643754 | 9 359.0485 | 25.68% |

| 0x0ed7c469… (Dec‑10‑2024) | 45 020.591631410438078425 gCRV | 241.229517575500643813 gCRV | 668.2557081017895946 gCRV | 45 930.0768570877 | 35 990.28790559192835372 gCRV | 9 906.663151290662846919 gCRV | 33.125800205137116199 gCRV | 10 849.27417717309 gCRV | 23.62% |

| 0x1078656c… (Jan‑22‑2025) | 35 232.298125461949641378 gCRV | 250.543816109760678687 gCRV | 646.932796379129143172 gCRV | 36 129.7747379508 | 28 154.009884264068788622 gCRV | 7 933.988160471292147391 gCRV | 41.776693215478527224 gCRV | 8 873.24146617566 gCRV | 24.56% |

| 0xda6a7297… (Feb‑2025) | 34 511.967571610342395709 gCRV | 443.091230908513138718 gCRV | 615.210100804645964902 gCRV | 35 570.2689033235 | 27 593.499898616364967804 gCRV | 7 955.30360972197549863 gCRV | 21.465394985161032895 gCRV | 9 035.07033642030 gCRV | 25.40% |

| 0xefe2458c… (Dec‑25‑2024) | 32 735.704353412513955254 gCRV | 426.9603965243397999064 gCRV | 736.009534388948829578 gCRV | 33 898.67428432580 | 26 173.884992738489720657 gCRV | 7 705.611845896201275036 gCRV | 19.177445691111589045 gCRV (leftover, computed) | 8 887.7592225006 gCRV | 26.22% |

| 0x326c0a71… (Dec‑10‑2024) | 31 692.15793765376322185 gCRV | 322.51386798506768177 gCRV | 417.822124602141027416 gCRV | 32 432.49393024097 | 25 342.683285615239833188 gCRV | No direct gCRV to operator (all gCRV stayed in Safe) | 7 089.810644625733 gCRV (large residual) | 7 830.14663721294 gCRV | 24.14% |

| 0xb0632a3d… (Nov‑2024) | 29 734.809902406241716565 gCRV | 614.010273842449880835 gCRV | 1 200.041574720375621852 gCRV | 31 548.86175096907 | 23 783.797526726430699617 gCRV | 7 759.07905981606775739 gCRV | 5.985164426568762245 gCRV | 9 579.11607280547 gCRV | 30.36% |

| 0x1eb44f82… (Nov‑2024) | 39 386.50631815370158992 gCRV | 252.956030414524374837 gCRV | 446.223156081884935393 gCRV | 40 085.6855046501 | 31 504.019718249174789611 gCRV | 8 561.328407546135582067 gCRV | 20.337378854800528472 gCRV | 9 280.84497289735 gCRV | 23.15% |

| 0x4e29fe7b… (Nov‑2024) | 34 958.769083526833293876 gCRV | 364.460159397849446363 gCRV | 688.655646176822797003 gCRV | 36 011.884889101505 | 27 947.915397701104345305 gCRV | 8 036.443558159210298578 gCRV | 27.525933241190893359 gCRV | 9 117.085296975074 gCRV | 25.32% |

| 0x219989bc… (Oct‑2024) | 44 771.084358852505446152 gCRV | 786.707414494287589624 gCRV | 1 733.777922887305373039 gCRV | 47 291.569696234095 | 35 789.811315798649807444 gCRV | 11 467.095743723688427716 gCRV | 34.662636711760173655 gCRV | 14 022.243717817042 gCRV | 29.65% |

| 0xfead9e7b… (Sep‑2024) | 88 130.872858940609251656 gCRV | 709.311324087051270871 gCRV | 782.901863078607695865 gCRV | 89 623.08604610625 | 70 440.205829304022025299 gCRV | 19 101.737697635892137188 gCRV | 81.142519166354055905 gCRV | 20 675.09340396791 gCRV | 23.07% |

| 0xf2df6f2e… (Sep‑2024) | 34 418.731173133485577026 gCRV | 415.445659359707940801 gCRV | 642.923817288195049519 gCRV | 35 477.100649781388567 | 27 506.431838379316677104 gCRV | 7 932.347041?* gCRV (operator) | 38.33 gCRV (approx residual) | 9 029.04 gCRV | ≈25.45 % |

Shows distributions in the last year and approximately how much was withheld (~25% scam fee) Interestingly, I couldn’t see a fee taken for the last resync, since transition from the Union/Votium to StakeDao. Perhaps he hasn’t set up his contract for it yet.

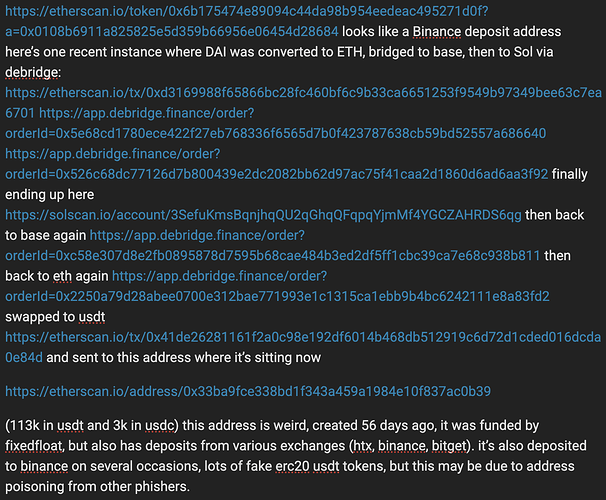

The majority of the fee is converted to DAI, which is then offramped to exchanges, eg.

Recent update:

Looks like StakeDao splits up the biweekly distribution into 2 claims, the first claim AZ did indeed send to PBM (as I posted above), the other half (sent 2 days ago) he sent $16k to his personal wallet to buy more USDM and deposit in PBM again-this time ~300k USDM. (Sorry can’t post screenshot or link wallet. Can’t post more than 1 embedded media as new user.)

So I guess his new plan is this: every cycle, take half of the vlCVX rewards and send to personal wallet (0xf6c40C4391D6570032D2EB7A9CD9935898c430CF) to buy and stake USDM to earn a bigger share of the rewards in the name of “recovering peg” (in reality he’s just taking half the rewards and then staking them to earn even more rewards for himself) the other half accrues to PBM stakers as usual, but now he’s stealing a bigger share of this now as well (1.3m USDM and counting) that means his scam fee is now 50% + 1.3m/24m (TVL of PBM) = 55% again.

So what do the teams of Curve, Convex, StakeDAO, and Yearn recommend that we do? The health of our industry depends on our ability to police bad actors. This request for proposals from the four teams is being cross posted to each governance forum. If there is a meta-forum, we’d be pleased to move our request there. We’re hoping for optimal solutions that help our Curve Federation.