Highlights

- Finalised the preliminary work on decentralisation

- Deployed the CCIP bridge

- Ramped up veCAKE votemarket

Product

January retrospective

- Worked on OnlyBoost audit fixes

- Worked on PancakeSwap strategies which involve NFTs (v3 positions)

- Deployed the CCIP SDT bridge

- Deployed the new Angle voter contract to adapt to Angle’s new onchain governance

- Deployed Binance web3 wallet connection

- Created a Dune dashboard to track the deployment of the Arbitrum grant

- Optimized our infrastructure to save on hosting costs

Focus for February

- Deploy CAKE Strategies

- Deploy Only Boost

- Migrate all the strategies to the new architecture for massive gas cost improvement and better security

- Migrate all the accumulators to the new architecture

- Build and Deploy Convergence Market on Votemarket

- Rethink the SDT Distribution process for gas-cost efficiency and less operational management

- Automate the management of OTC bribes with a new OTC bribe registry contract

- Create a dune Dashboard for SDT

- Deploy veSDT Market on Votemarket

Business development

January retrospective

- Performed the necessary actions for the reception of the Arbitrum and Binance grants (but not received yet)

- Converted 1m CRV out of the 6m CRV voted by Aave Governance to be deployed on Stake DAO

- Attracted significant vote incentives on Pancake Votemarket in the initial rounds

- sdCRV peg back from 0.92 to 0.96 CRV

- Onboarded several veCAKE bribers to votemarket and reached $30k of bribes per round (notably with the onboarding of Overnight)

Focus for February

- Converting the remaining 5m CRV from the Aave GLC as per the governance vote.

- Receiving the Binance and Arbitrum grants and starting deploying them.

- Converting CRV unlocked from August OTC to sdCRV

- Distributor deals for sdCAKE and CAKE strategies

- Bringing sdCRV back to peg

Financials

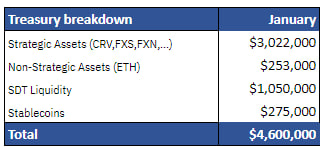

[Stake DAO treasury](https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063)

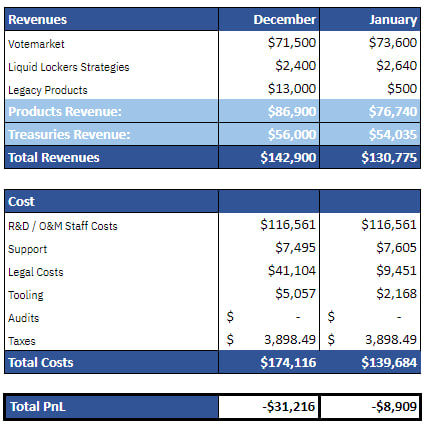

P&L

Legal costs are exceptional and should keep going in Q1 2024 but should go down significantly after. Legacy products revenues are also mostly exceptional (exit fees on old strategies).

Legal & Governance

January retrospective

- Landed on a legal structure that will be proposed to the DAO in February.

- Performed KYC and KYB for grant reception from Binance and Arbitrum.

- Proposals published to reduce SDT inflation and to reward

Focus for February

- Propose the role of the association to the governance

- Subject to favorable vote from governance:

- Migrate ownership of tools and media to the association

- Commercial registration of the association

- Opening bank account for the association

- Push proposal for on-chain voting infrastructure

- Push proposal for multisig structure and treasury management