Proposed by: Hubert

Summary

Six months after the launch of OnlyBoost, the market has changed a lot, and an update of the OnlyBoost formula seems to be required.

Context

Since the launch of OnlyBoost, a lot has happened:

- Stake DAO doubled its veCRV holdings, going from c.60m to close to 120m veCRV;

- The total supply of veCRV increased significantly to over 800m, but overall, Stake DAO’s share rose from less than 10% to nearly 15%;

- Convex’s incentive reduced significantly from 0.0086 CVX (~$0.021) per CRV harvested, to 0.0025 CVX (~$0.004) per CRV harvested, representing a ~1.5% boost on CRV APR for funds deposited on Convex;

- Stake DAO saw a growth in TVL that allowed to reduce the harvester fee to 0.5% from 1%;

- We pushed our boost delegation infrastructure and to date received 72m of veCRV boost (which should in the medium term converge towards 50m veCRV boost), bringing the total boosting power of Stake DAO to 190m veCRV, representing 24% of the total boosting power supply, and half of Convex’s boosting power!

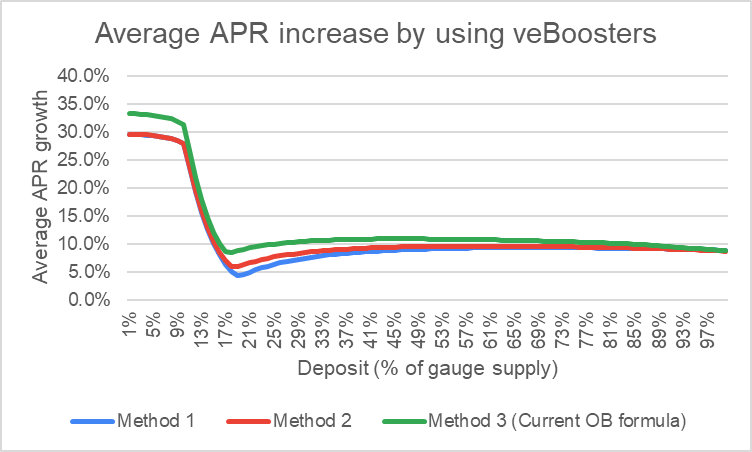

With this evolution in the market, OnlyBoost became more and more competitive. When it was launched, Onlyboost could improve the user APR by more than 30% for up to 10% of the gauge, and could then guarantee a minimum user APR improvement of 9%:

Exhibit 1: Onlyboost APR improvement at launch

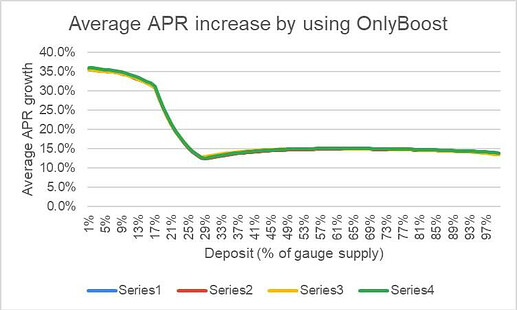

Today, with the current formula, OnlyBoost can improve the user APR by more than 30% on average for up to 17% of the gauge, and then guarantee a minimum user APR improvement of 12.5%:

Exhibit 2: Onlyboost APR improvement today

Rationale

With this evolution of the market, we need to do a couple of change in the OnlyBoost formula.

1. Account for veCRV boost delegated

When OnlyBoost was launched, the veCRV boost contract wasn’t live, but now we need to include it in the calculation to benefit from the boost delegated to us through the boost delegation infrastructure.

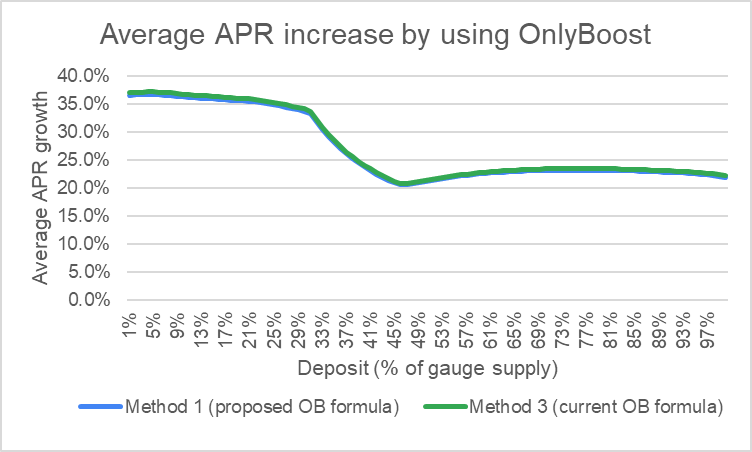

Accounting for the boost freshly delegated would allow OnlyBoost to improve user APR of 35-40% on average, with a median at 41% for additional deposits of up to 32% of the gauge, and to guarantee a minimum APR improvement exceeding 20%.

Exhibit 3: Onlyboost APR improvement after the proposed update

2. Formula simplification

As expressed previously, the fees of Stake DAO now accounts for 15.5% of CRV harvested, while Convex’s fees stayed at 17%, partially offset by their incentives for 1.5%. Convex’s net fee is therefore equal to 15.5%, like Stake DAO’s fee.

The fact that those fees are now equal considerably simplifies the optimisation formula.

As a reminder, OnlyBoost works by assessing a target optimal balance that should be deposited directly on Curve using Stake DAO’s boost, and the rest being deposited on Convex. Currently, the formula to calculate this balance is the following:

bsd = 3 (1 - fsd) bcvx wsd S0 / [ 2 (fsd - Fcvx) bcvx W + 3 wcvx S0 ( 1 - Fcvx) ]

Where bsd is the target Stake DAO balance, fsd is Stake DAO fees, and Fcvx Convex net fees (fees minus incentives). If you have:

fsd = Fcvx

Then the formula simplifies into:

bsd = bcvx wsd / wcvx

This is the formula of “method 1”. Whereas six months ago there used to be a significant difference with “method 3” which is the current formula used by OnlyBoost, as shown on exhibit 1, with the alignment of fees and incentives between Convex and Stake DAO there is no such difference today (on Exhibit 3, both lines merge).

We therefore propose updating the formula of target balance to reduce significantly the gas costs of rebalancing (and calling the formula module).

Means

Minimal resources should be required, approximately one day of smart contract developer estimated.

Technical implementation

OnlyBoost has been designed in a way that facilitates updates in the formula. The target balance is calculated by a module which is called by the strategy. To update the formula, we just need to change the module for one with the new formula. No user migration will be required.

Steps are the following:

- Update the module and test it

- Deploy the new module

- Replace the current module in the Curve Strategy contract

Timeline

We should do the update as soon as possible to quickly benefit from the increase in fee generating TVL it will bring. After the vote, we should target one week to deploy execute the proposal.

Proposal specifications:

Admin(s): veSDT holders

Community feedback: 3 days

Voting duration: 7 days

- I am in favor of the OnlyBoost formula update

- Don’t change anything