Proposer: Hubert

Summary

This proposal is to progressively replace all yield strategies proposed by Stake DAO by a new version, more efficient and with a better user experience.

Context

As part of the roadmap defined at the beginning of the year, and the milestones detailed in the H1-25 Stake DAO Association grant, contributors have been working on a new infrastructure of LP token staking to replace the current yield strategies proposed by Stake DAO.

The problem it tries to address is the lack of competitiveness of Stake DAO strategies in phases of steep TVL growth, or for large depositors. This has limited our growth especially where we are not already broadly known (for example on Pendle), or even for new pools being deployed. More detail on today’s model limitations can be found in section 2 of the Staking v2 Whitepaper.

This problem is common to all yield aggregators in the space, and it is notably shared with Convex, Yearn, Aura, Magpie, etc… Solving it would provide a massive competitive advantage to Stake DAO.

Rationale

V2 Vaults allow users to avoid all the complications of today’s infrastructure, and guarantee them:

- Instant reward distribution: the seven-day delay between the moment the

user’s funds generate the rewards and the moment the user receives them

does not exist anymore;

- No loss of rewards when leaving a strategy: when leaving a strategy, a user

can claim all the remaining unclaimed rewards generated by their funds;

- No reward squatting: thanks to the Accountant contract, new depositors do

not ”squat” the rewards generated by existing depositors;

- No pause of rewards if the pool is not harvested: thanks to reward pooling,

users can always claim the rewards they generate;

- Reduced harvest costs: in its initial deployment, v2 vaults will have an

harvester fee five times as low as the current harvester fee.

This new infrastructure would allow Stake DAO to avoid the very common case where a whale tests Stake DAO for the first time, doesn’t see their rewards flowing as quickly as expected because they diluted the pool, and withdraws a few moments later.

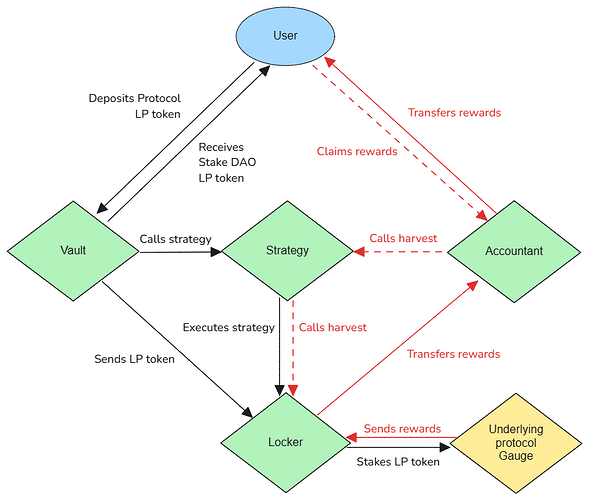

This will be done thanks to a new Accountant contract which will be in charge of calculating the rewards allocation to users based on what their funds generated.

Below, a quick overview of the new architecture:

There will also be a whole new management of rewards that will reduce the need for frequent harvests and ensure rewards are always flowing for every pool. This is done through cross-vaults reward pooling. More details about this feature are available in the whitepaper, section 3.2.

Implementation details

Those benefits require a complete overhaul of the architecture used by Stake DAO. Therefore a migration will be required from users, and until they migrate, their funds will not be put to work anymore. It will therefore be a sensitive process where communication will be key to maximise user satisfaction. Furthermore, if funds remain in the old contract for a long period of time, it could result in a lack of revenues for the DAO. Therefore, the proposed approach is to migrate progressively to the new architecture. At first, all non-curve strategies would be migrated. Then Curve strategies with lowest TVL and incentives would follow. And the process will finish with the largest Stake DAO strategies.

If this proposal is accepted, the DAO will give the responsibility to select the strategies to be migrated to StakeDAO Association, until the full migration is performed.

The proposed fee structure of the new strategies will be slightly different from the current one. Thanks to the reward pooling feature, the harvest fee can be significantly reduced. Also, for an accurate Onlyboost formula on Curve strategies, the sum of fees and incentives need to be equal between Stake DAO and Convex. Convex currently has 17.5% fees, and offsets approximately 0.7% of fees with CVX incentives (and going down as inflation reduces). Therefore, to align on Convex fees, Stake DAO fees will be adjusted to the following:

- 5% boost rental fee paid to sdCRV-gauge holders (no change);

- 6% performance fee sent to the veSDT fee distributor (and in time to vlSDT holders should the vlSDT migration be accepted by governance) (+1ppt v/s today)

- 6% performance fee going to Stake DAO treasury (+1ppt v/s today)

- Harvester fee: 0.05% of rewards harvested (-0.45ppt v/s today). This fee can be adjusted by Stake DAO Association in a range between 0% and 0.1% to maximise the user experience. Any change to this range would need to be voted again by governance.

All technical details regarding v2 Vaults can be found in the whitepaper.

Proposal Specifications:

- Admin(s): veSDT holders

- Community Feedback Period: Minimum of 3 days

- Voting Duration: 7 days

All actions and implementations described in this proposal will adhere to applicable laws and regulations to ensure legal compliance and uphold the integrity of Stake DAO’s operations.