Summary

Building on SDIP #5, this proposal outlines a mechanism for the DAO to begin accumulating its SDT/ETH liquidity on AMMs. Currently, there is $5.5M in total liquidity for SDT/ETH between Uni ($3.9M) and Sushi ($1.6M). In order to maintain this liquidity, StakeDAO is incentivizing these pools with 1 SDT per block. This translates to roughly 7,000 SDT per day, or $3.5M in annual emissions at the current SDT price.

This proposal is born out of discussions with the team at OlympusDAO and aims to replicate their bond mechanics to offer bonds that sell xSDT at a discount in exchange for SDT/ETH LP tokens. As a pilot we can contribute an equivalent amount of current SDT/Block rewards towards these bonds for 1 month and assess the impact on liquidity accumulation and token price. This would translate to roughly 200k SDT offered as bonds during the pilot program.

Motivation

Shift from the initial liquidity mining phase of SDT to reduce the supply per block and enable the DAO to own its own liquidity. Implementing bonds reduces the need for SDT incentives which only create temporary liquidity and persistent sell pressure. Importantly, bonds incentivize active StakeDAO members to participate in the program and help distribute tokens to these users.

Specification

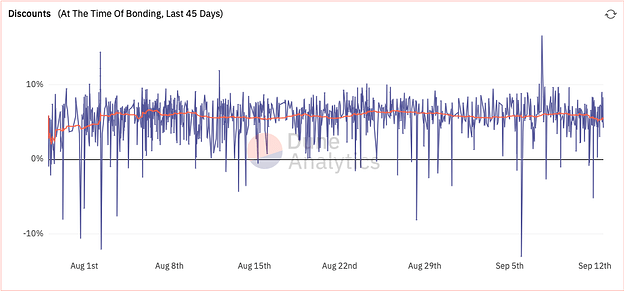

For those unfamiliar with the Olympus bond mechanism, the bond contract essentially sells a token (ex: xSDT) at a discount in exchange for assets (ex: SDT/ETH LP tokens). Bonds operate by initializing the price for LP tokens above market price and then applying a discount function that decrements price until a bond is purchased, which pushes the bond price back up. This mechanism allows the market to determine the optimal price for bonds. For reference, here is the average discount of OHM bonds with their extremely high APY:

Olympus is offering to provide its expertise in bond contract management to support other DAOs interested in owning their own liquidity. This will include providing the UI for bonds and maintaining bond control variables to balance emissions with liquidity accumulation. In exchange for the implementation and community engagement, Olympus would take 3.3% of all xSDT sold and use as backing for OHM. This will align the success of our communities and allow for cross-DAO governance participation.

StakeDAO’s bonds would be offered with a 7-day vesting period to ensure that discount buyers are incentivized to hold their positions. This helps align the goals of bond participants with the goals of the DAO. Bonds will be paid out in xSDT in order to save users the gas cost of staking. In addition to purchasing SDT at a discount, bonders know that they are providing permanent liquidity to StakeDAO’s treasury. An additional benefit of bond programs is that they eliminate impermanent loss inherent in traditional liquidity mining and the discount is locked in at the point of purchase.

Proposed Bond Program:

- Accumulate SDT/ETH liquidity on Sushi

- Bond 200k xSDT over 4 weeks

- Vesting period: 7 days

- Max bond payout: 4,856 xSDT

For

- Implementing bonds for SDT/ETH liquidity adds value to the DAO treasury

- Protocol-owned-liquidity allows liquidity incentives to be tapered over time

- Lower SDT emissions in the long-term should improve tokenomics

Against

- Reducing incentives for SDT/ETH impacts LP farmers

- Higher SDT emissions via bonds in the short-term may cause sell pressure