Summary:

Create a new partnership between Stake DAO and Lend Flare by:

- Building a LFT liquid locker on Stake DAO.

- Building passive strategies on Stake DAO for single asset deposits on Ethereum, which rely on Lend Flare platform.

- Admitting Stake DAO Curve LP as collateral on Lend Flare platform.

- Doing co-marketing.

Project Presentation:

- Protocol name: Lend Flare

- Audit(s) links: Certik

- Supported chain(s): Ethereum

- Twitter/Discord/Telegram links: Twitter/Discord/Telegram

Project metrics:

- Current protocol TVL: 35-40m

- Daily volume: 0-10m

- Community size on Twitter/Discord/Telegram: 8,7K/1,3K/2,5K.

Rational:

Context and motivation

More than a dex, Curve can be seen as a liquidity reserve or somehow a DeFi saving account. At the moment, this liquidity earns a yield composed of curve rewards and trading fees. Nevertheless, there are few additional opportunities for curve LP holders to take advantage of this huge liquidity, especially with low risk and high flexibility. Lend Flare aims to provide an optimized solution to this problem.

Lend Flare is a decentralized borrowing platform on Ethereum blockchain. Its added value is to allow Curve LP holders (the borrowers) to draw fixed-rate, fixed term and high LTV loans against Curve LP used as collateral, with no concerns for assets being liquidated due to price fluctuation, and without commission fees.

Liquidity providers (the lenders) who deposit loan liquidity for borrowers on Lend Flare receive in exchange a share of loan fees and an incentive in LFT token (Lend Flare governance token) for their participation. LFT tokenomics follow the curve ve-model, with a fair launch (no seed round, team get 3% of max supply with a 2-year linear vesting)

Stake DAO is a non-custodial platform that enables anyone to easily grow their crypto portfolio, by curating the top strategies, staking protocols, and more, into one intuitive dashboard. As Lend Flare Team, we believe that Lend Flare low risk products could fit perfectly in the strategies Stake DAO is looking for, and so both protocols can benefit from a mutual partnership.

Concerning the LFT liquid locker:

As shown in this Stake DAO article, the first point would be for Stake DAO to build a liquid locker for Lend Flare native token (LFT), similar to the ones already existing for Angle, FXS and CRV tokens.

Concerning the Stake DAO passive strategies for single asset deposits:

Currently, the Stake DAO passive strategies accept mainly Curve LP tokens. Lend Flare proposes to add new ones on Stake DAO app. It will allow Stake DAO users to deposit single tokens (at the moment, USDC/DAI/wBTC/ETH) on Lend Flare (through Stake DAO) as loan liquidity suppliers.

An example:

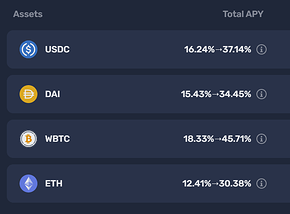

Below, the current (20/04/2022, 10:30 utc) yields on Lend Flare.

Stake DAO users could receive a 16,24%-37,14% apy yield on single USDC deposits (gross yields, not including Stake DAO incentives or fees).

With the benefits of the above LFT liquid locker, Stake DAO users could receive the highest yield, i.e 37,14% for USDC deposits, in addition with all the benefits of the LFT liquid locker itself.

→ All in all, thanks to Lend Flare, Stake DAO users get access to new strategies with attractive yield and low risk.

Concerning the admission of Stake DAO Curve LP on Lend Flare:

Currently, the passive strategies accept curve LP tokens and deposit them on Convex (which in turn deposits them in Curve). With the incoming update of Stake DAO curve LP strategies, Lend Flare could admit Stake DAO curve LP as collateral on Lend Flare app. Consequently, Stake DAO users could borrow on Lend Flare.

It will allow low risk/high LTV loans and, if loans are compounded, low-risk leverages on Stake DAO curve LP deposited on Lend Flare. In the last case, rewards and yields for Stake DAO users are considerably boosted.

An example :

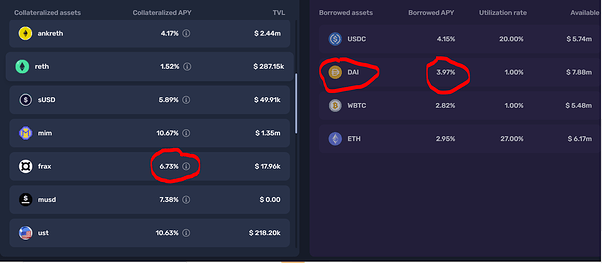

Firstly, let’s use frax3crv for this example.

Secondly, let’s make the assumption that yields on Stake DAO will be similar to Convex.

At the moment, Convex proposes a yield of 6.73% veAPR frax3crv (as of 20/04/2022, 10:30 utc).

By depositing frax3crv on LendFlare, frax3crv gets 6.73% APR, without leverage. It’s the Stake DAO yield, without leverage.

If Stake DAO users borrow DAI on Lend Flare (currently at 3.97% APY, see picture), convert back the DAI to frax3crv, and reach a chosen X leverage on the initial frax3crv position, Stake DAO users would get a yield of:

Yield(chosen X leverage) = (frax3crv yield without leverage of 6.73%) + [(chosen X leverage) - 1]*[(frax3crv yield without leverage of 6.73%)-(DAI borrow rate of 3.97%)]

Table with the leverage and corresponding yields:

| Leverage | Corresponding yield (apr) |

|---|---|

| 1 | 6,73% |

| 2 | 9,49% |

| 3 | 12,25% |

| 4 | 15,01% |

| 5 | 17,77% |

| 6 | 20,53% |

At x6 leverage, frax3crv has to depeg to 0,878$ to be liquidated. Auto-leverage positions (similar to Abracadabra Degenbox) are going to be available in Lend Flare V3.

→ All in all, thanks to Lend Flare, future Stake DAO Curve LP could receive significantly improved yields at a low risk.

Concerning co-marketing:

The main actions will be:

- Create twitter space and have live AMA with Stake DAO / Lend Flare communities

- Create a joint F.A.Q on Lend Flare and Stake DAO documentations, explaining the benefits of both protocols working together.

- Mutual communication inside both communties, about important news or incoming updates.

Benefits for Stake DAO:

- Allow exposure of Stake DAO users to Lend Flare project and LFT token.

- Allow more diversified and optimised Curve LP strategies for Stake DAO users.

- Allow new single asset strategies for Stake DAO users.

Benefits for Lend Flare:

- Liquidity for staked LFT tokens

- Perpetual passive strategy for staked LFT tokens

- Increase of Curve LP collaterals deposited (increase of LendFlare TVL)

- Increase of loan liquidity (increase of LendFlare TVL)

Mean:

- Human resources: Mainly devs from Stake DAO for the LFT liquid locker and the single asset strategie integrations. Mainly Lend Flare devs for the Curve LP strategies.

- Treasury resources: No treasury resources needed.

Technical implementation:

- add a new liquid locker on Stake DAO.

- add new passive strategies on Stake DAO (compound on Lend Flare smart contracts).

- add a new collateral (Stake DAO curve LP) on Lend Flare.

Timeline and Roadmap:

- For the LFT liquid locker, as soon as the Stake DAO team could.

- For the new passive strategies, to be discussed between both parties.

- For the Stake DAO curve LP as collateral on Lend Flare, to be discussed between both parties.

Voting options:

- Yes, for the LFT liquidity locker + new single asset strategies + new curve LP strategies + co-marketing

- Abstain

- No

The Lend Flare team

Lend Flare app

Lend Flare Documentation

Lend Flare Twitter

Lend Flare Discord