Highlights

- New Votemarket Analytics

- Arbitrum sdCRV voting was enabled

- Promising ramp up of Onlyboost TVL

Product

April retrospective

- New Votemarket analytics

- Update sdCRV snapshot to include vsdCRV on Arbitrum

- Improvements made to the automation

- Deployed new Curve factory

- Llamalend strategies UI

Focus for May

- Redeployment of Votemarket cross chain

- Possibility to take part in IFOs for sdCAKE holders

- Non v3 strategies on Stake DAO PancakeSwap

- Cross chain strategies on Stake DAO PancakeSwap

- Fraxtal FXS locker

- Revamping of Pendle voter rewards distribution

Business development

April retrospective

- Updated Defillama TVL

- Submitted Arbitrum STIP Bridge grant request

- Updated the Arbitrum grant Dune dashboard

- 1m additional CRV migrated from cvxCRV to sdCRV by Aave

- sdCRV repeg

- Deployed the Arbitrum asdCRV/CRV Ajna pool

- Increased the TVL of Arbitrum pool to $700k

- Onlyboost inflows: $8m

- Main Onlyboost strategies:

- crvUSD/tBTC/wsteth ($1.5m, 17% of Curve TVL)

- Llamalend crvUSD - WETH collateral ($1.3m, 15% of Curve TVL)

- USDT/crvUSD ($1.1m, 11% of Curve TVL)

- CRV/sdCRV ($0.7m, 37% of Curve TVL)

- ETH+/WETH ($0.7m, 28% of Curve TVL)

- With this approach, on those 5 strats only, Stake DAO is exposed to 1.4% of total CRV emissions

Focus for May

- asdCRV llamalend on Arbitrum

- Grow further the Arbitrum TVL

- Receive an STIP bridge grant and finish distributing the STIP grant

- Onlyboost expansion with focus on the following gauges:

- MIM/3CRV (5% of CRV emissions)

- OETH and OUSD pools (3% of CRV emissions)

- Tricrypto pools (9% of CRV emissions)

- pyUSD/crvUSD

Financials

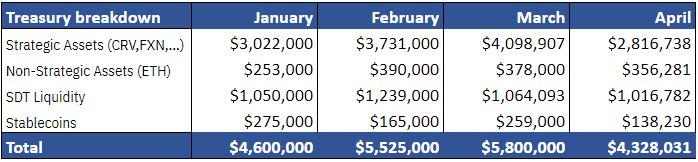

[Stake DAO treasury](https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063)

- Market drop (in particular for CRV) severely hit the treasury value in April

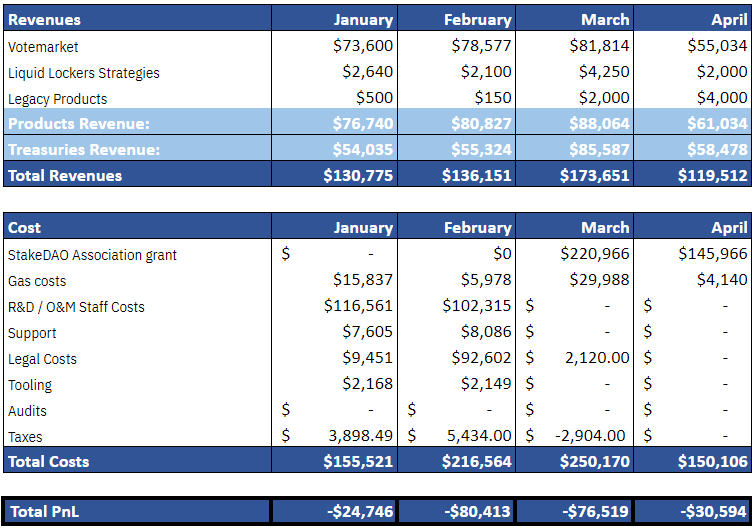

P&L

- CRV drop led to decrease in Votemarket and farming revenues which armed the DAO’s profitability.

Association grant use report

- The cost reduction efforts led by the Association enabled it to save $45k since the initial attribution of the grant. However, a c.$30k legal cost payment is expected to occur in the next month.

Legal & Governance

April retrospective

- Multisig signer election was performed and executed

- STIP bridge grant request was submitted

Focus for May

- Commercial registration of the Association

- Bank account

- Team alignment proposal

- Recovery of missing Foundation funds

- veSDT rewards proposal

- SDT liquidity proposal