Highlights

- First audit successfully passed for new staking infrastructure

- CAKE and ANGLE locker shutdown

- New Spectra locker deployed

Product (Strategy/Smart contracts/UI/Development)

April retrospective

- Staking v2 passed the first audit, fixes done and reviewed

- Staking v2 has been sent to a second audit

- Spectra locker shipped

- sdANGLE redemption

- sdCAKE redemption

Focus for May

- Shipping Staking v2

- Yieldnest locker deployed

- Deciding on a curation infrastructure provider

- Create a pre-launcher lockers factory

- vlCVX votes on veFXN VMv2

- Deploy a manager hook to allow unused incentives to be sent back to the manager

- Adjust sdPENDLE rewards from WETH to USDT (to adapt to the recent Pendle reward distribution update)

- Zerolend and Spectra strategies push

Business development

April retrospective

Despite the challenging market environment, April was a very successful month in terms of business development.

- 16% of vlCVX voted for Votemarket bribes

- Negotiations with PancakeSwap allowed to find an amicable outcome for the closure of the CAKE locker

- Reached 10% of veZERO supply in the first couple of weeks after the Zerolend locker launch

- The sdBAL locker also grew by >20%, exceeding 300k veBAL and 5% of the total veBAL supply

- asdPENDLE was launched by Aladdin but still lacks traction

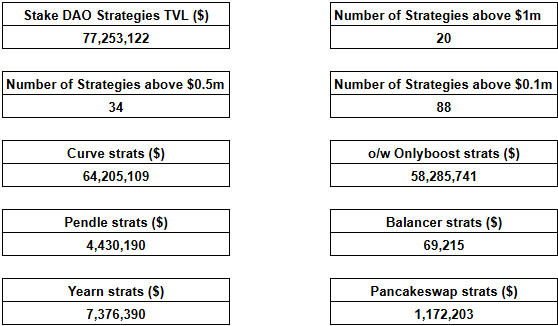

- Challenging markets were not enough to offset the growth in OnlyBoost strategies on Curve, and in overall Stake DAO strategies:

- Total TVL in strategies: $77.2m (+$20m / +19% MoM)

- Onlyboost TVL: $58.3m (+$21m / +57% MoM)

- Number of strategies above $1m: 20 (+6 / +43% MoM)

- Number of strategies above $0.1m: 88 (-13 / -13% MoM)

Focus for May

- Staking v2 migration and marketing

- Push the reUSD/sDOLA, RSUP/WETH and reUSD/sfrxUSD strategies

- Yieldnest locker launch

- Seal a deal with TAC and Turtle

- Zerolend and Spectra strategies push

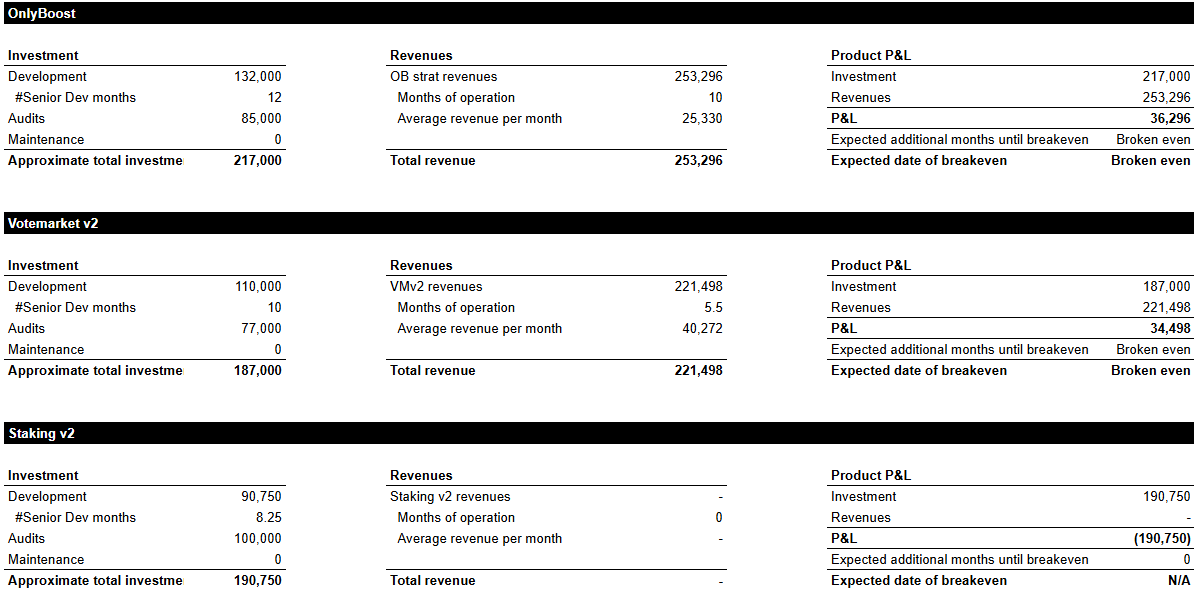

Product investment performance tracking

Both OnlyBoost and Votemarket v2 have now reached breakeven and are profitable, and Staking v2 is still a work in progress.

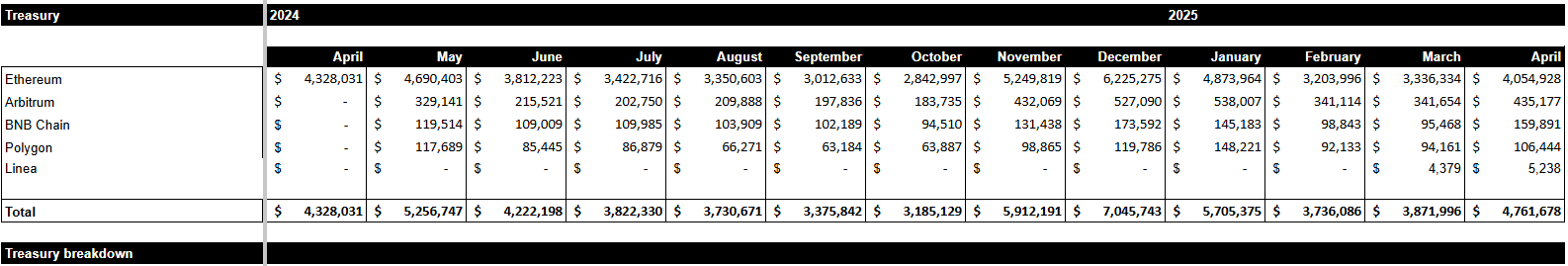

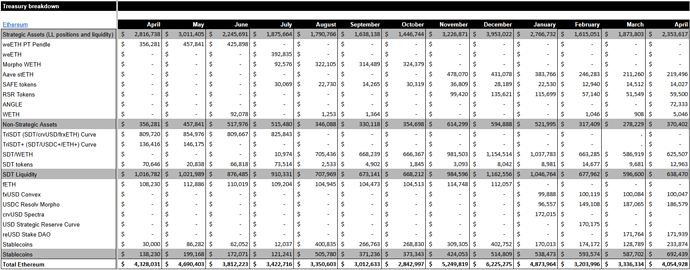

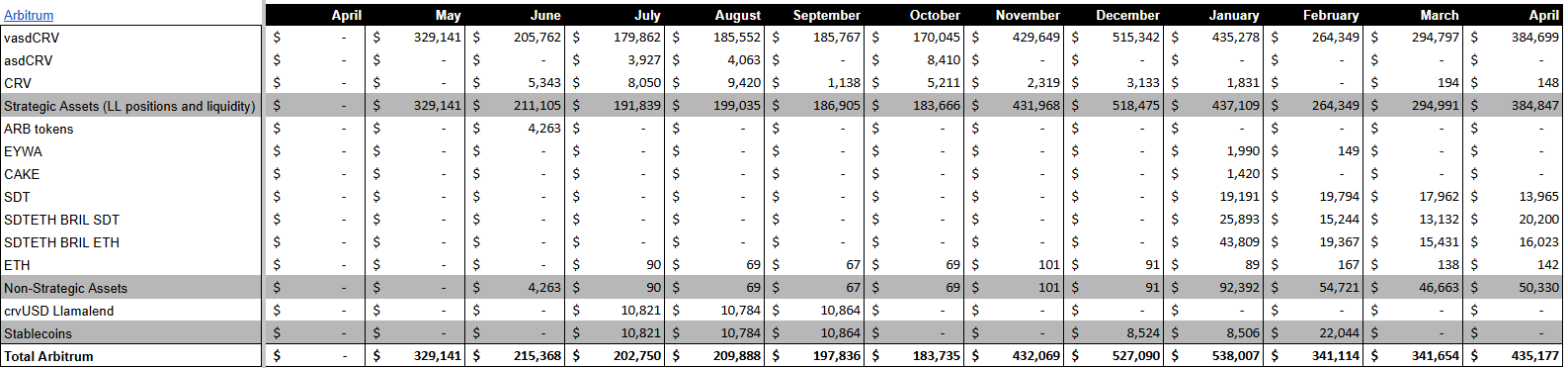

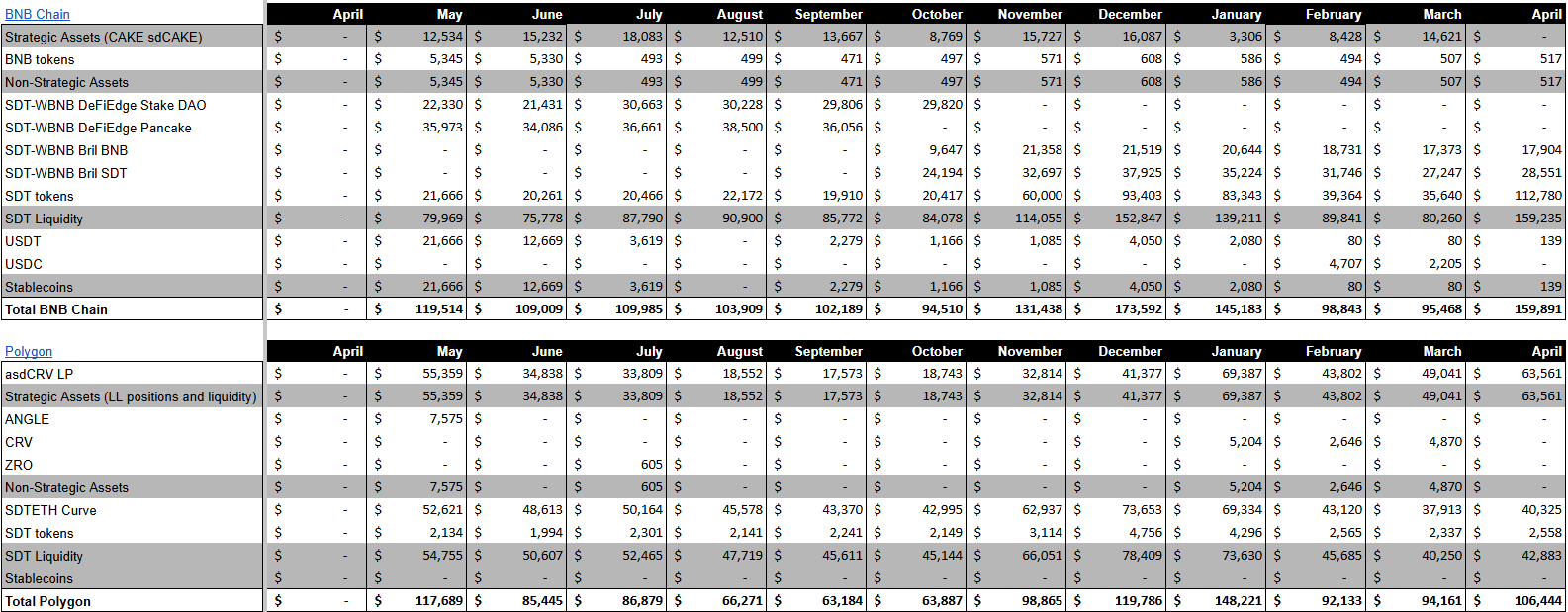

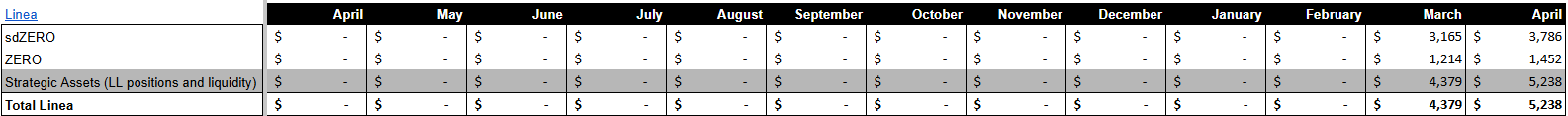

Financials

Stake DAO treasury : https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063

Despite market turmoil, the relative resilience of CRV and solid revenue generation allowed the treasury to keep a flat performance over the month.

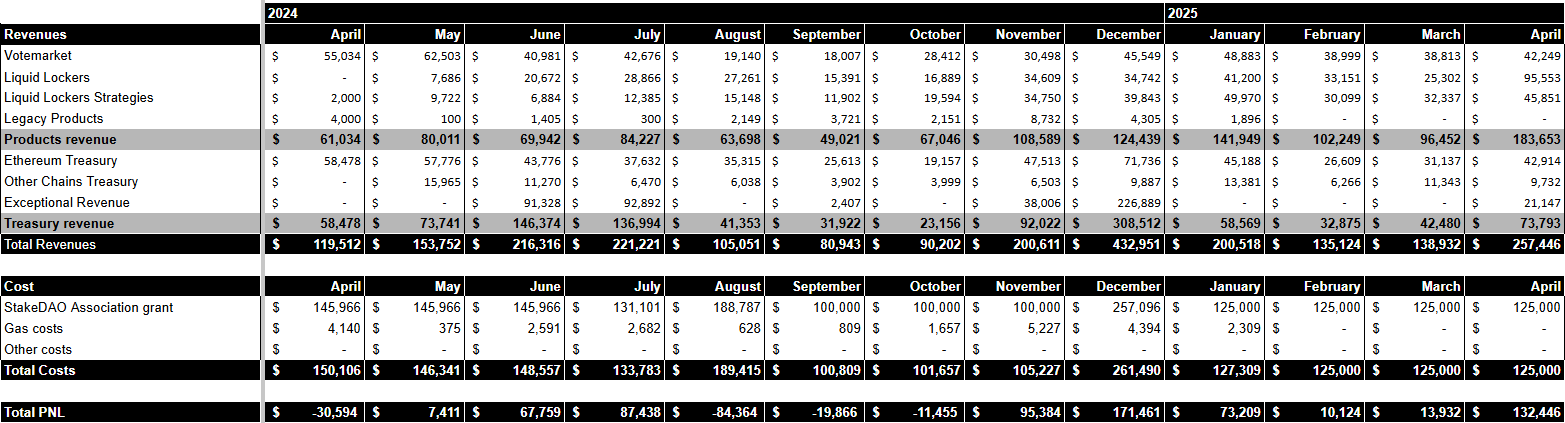

P&L

The DAO generated strong revenues this month, with a 42% growth on Strategies revenues, some exceptional revenues coming from the sdCAKE redemption, and a large Liquid Lockers’ revenue from the big distribution that was done to veANGLE holders and benefited the Angle liquid locker ($72k). The non-exceptional recurring revenue sat at $164k which represents an 18% growth compared to March.

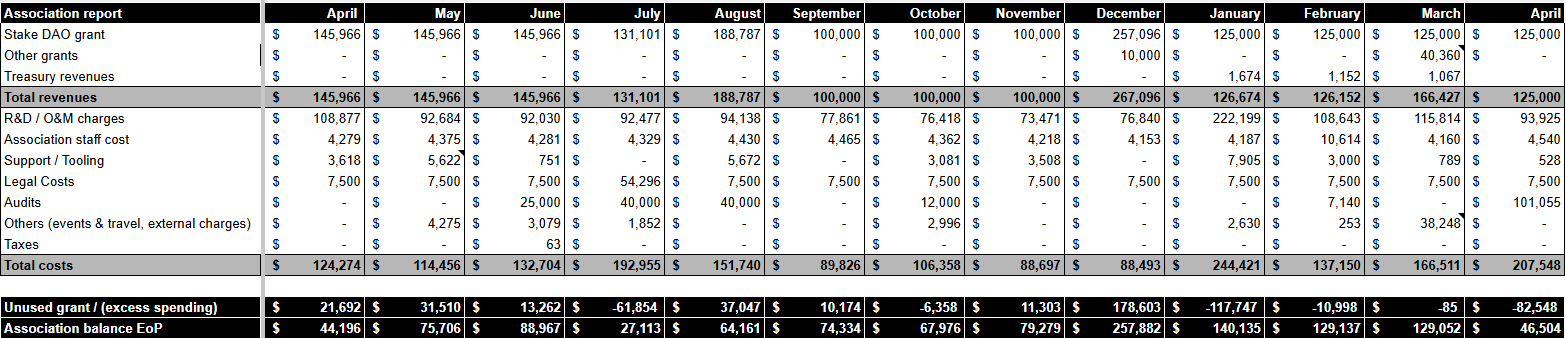

Association grant use report

The two audits for Staking v2 resulted in an exceptional cost of more than $100k. Despite that, the overall net profit of the activity over the period was approximately $50k.

Legal & governance

April retrospective

- sdCAKE redemption

- Redemption proposal for old rescued 3CRV and GNO was passed

Focus for May

- sdBAL liquidity scaling proposal

- Accepting ownership and migration of strategies towards Staking v2

- vlSDT migration proposal

- Hypernative integration proposal

- Transfer of socials’ accounts and missing legacy Foundation funds to Stake DAO Association