Highlights

- Staking v2 deployed on Ethereum mainnet for Curve

- Votemarket for Pendle deployed

- Very good results for the DAO

- Passed 4m vlCVX delegated to stakedao-delegation.eth

Product (Strategy/Smart contracts/UI/Development)

August retrospective

- Staking v2 was released on mainnet for Curve

- Second set of audits for v2 Morpho markets completed

- Launched the Votemarket Pendle market

- Fixed DefiLLama figures to align on Stake DAO’s real figures

Focus for September

- Launching Morpho markets using Staking v2

- Following the migration of mainnet TVL towards v2

- Selecting vault infrastructure for vaults built on top of Staking v2 strategies

Business development

August retrospective

- Side chains TVL surged on the back of broader Staking v2 adoption

- Stake DAO attracted and additional 500k vlCVX to its delegation, totalling 4m vlCVX delegated

- Reached $8.5k deposited on the first week of the Pendle Votemarket with 6 different depositors

- Solid performance of the Pendle strategies

- Market draw back in August impacted Stake DAO strategies’ TVL offsetting the great momentum of the month, ending with a flattish growth over the month:

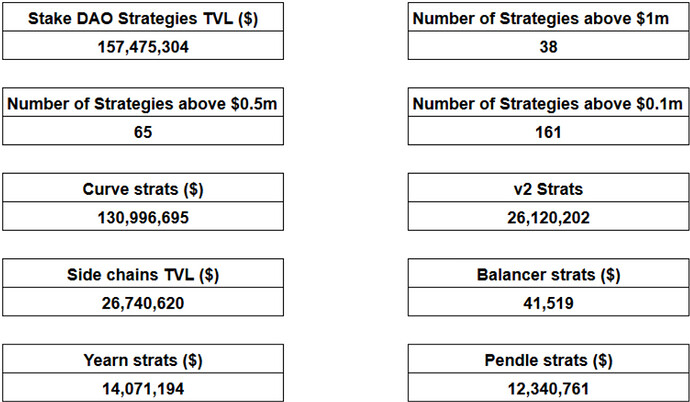

- Total TVL in strategies: $157.4m (+$2m / +1% MoM)

- Side chains TVL: $26.7m (+$12.1m / +83% MoM)

- v2 strategies TVL: $26.1m (+$14.0m / +116%)

- Number of strategies above $1m: 38 (+2 / +5% MoM)

- Number of strategies above $0.1m: 161 (+17 / +12% MoM)

- Yearn strategies’ TVL: $12.1m (+$0.1m / +1% MoM)

- Pendle strategies’ TVL: $12.3m (+$2.2m / +22% MoM)

Focus for September

- Secure commitment from key curators to curate on Stake DAO

- Secure an agreement with Resolv for a partnership regarding stRESOLV liquid wrapper provision

- Engage talks with Nexus mutual for a dedicated cover deal for Stake DAO vaults

- Manage a challenging situation regarding the YFI locker

- Start discussion with exchanges regarding potential listing of SDT

- Engage discussions with key yield aggregators to start integrating Staking v2: Reserve, Tokemak, Beefy, etc.

- Further develop Stake DAO veCRV boost market share through new boost-delegation agreements.

Financials

Stake DAO treasury : DeBank | Your go-to portfolio tracker for Ethereum and EVM

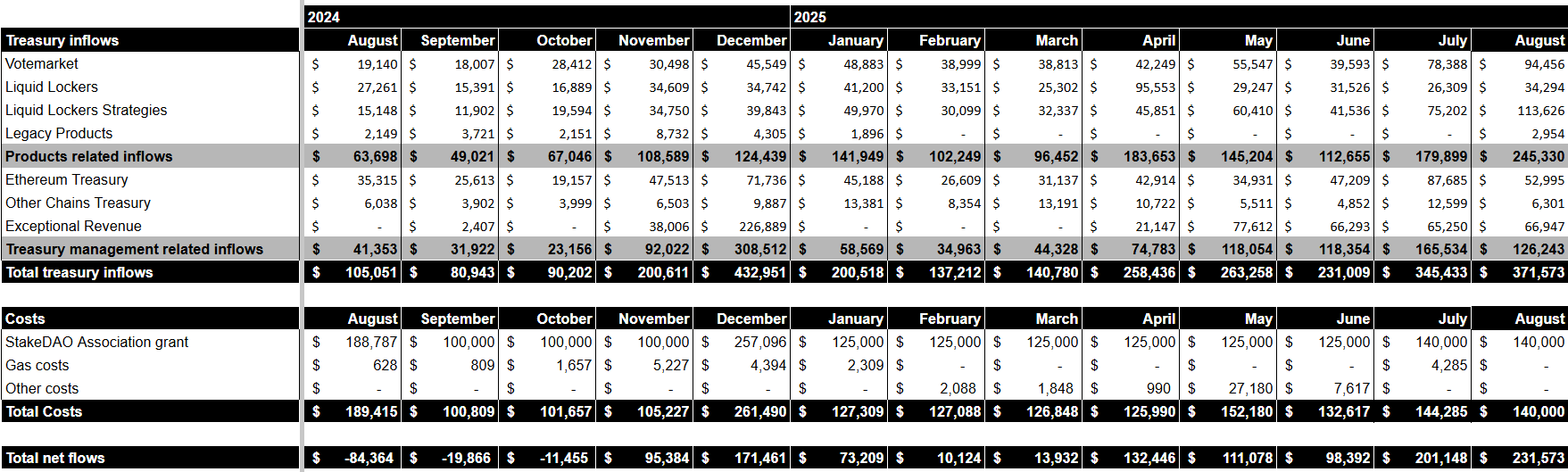

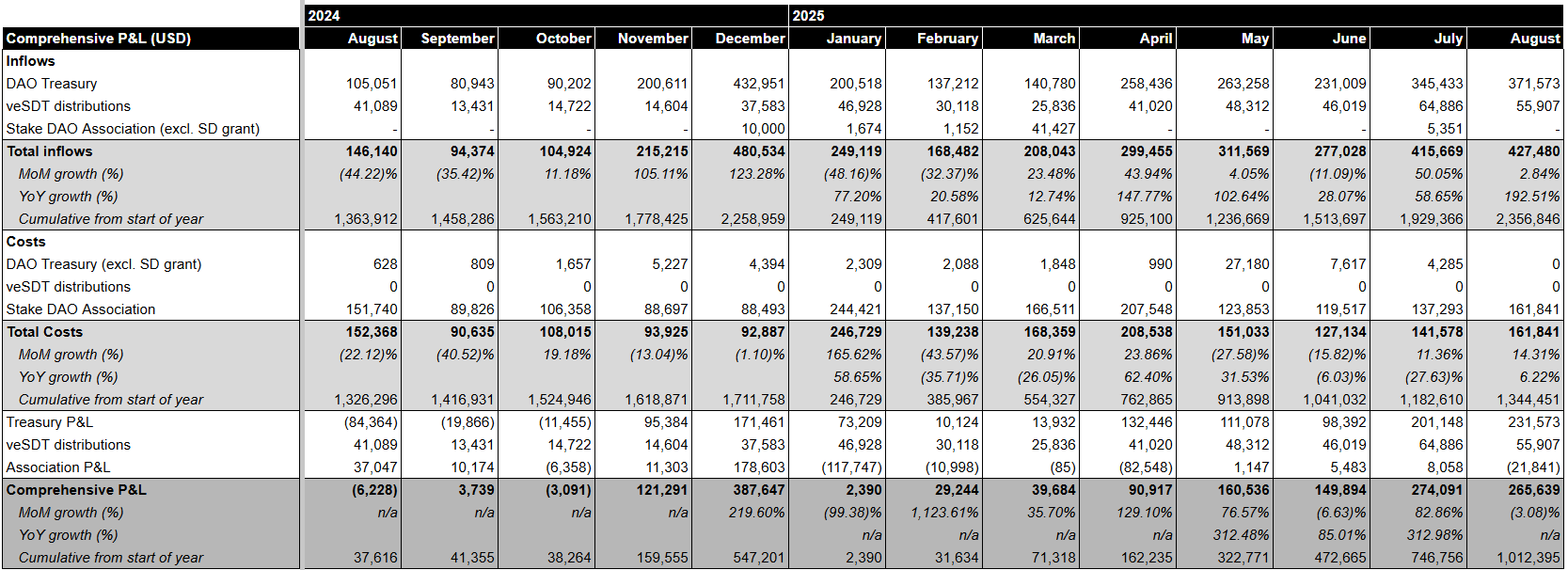

Strong fee generation more than offset the negative impact of the market downturn of the end of August.

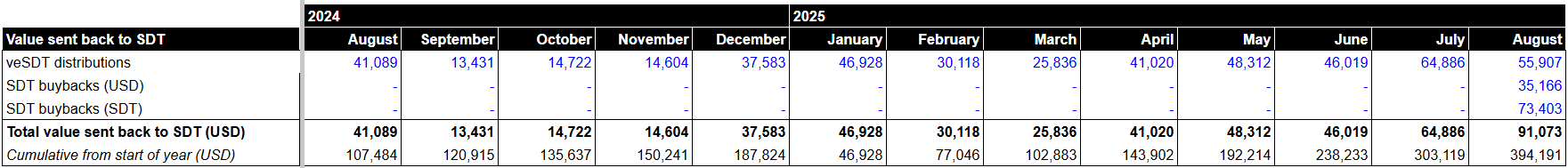

Net treasury cash flows

Despite a challenging market and a 23% drop of CRV over the month, fee generation increased for Stake DAO thanks to solid inflows into Stake DAO strategies following Staking v2 deployment on side chains (which include also the collection of one week of L2 fees of July), higher locker income thanks to Curve and Pendle strong performance, and a solid Votemarket output growth coming from the collection after 7 months of the first unclaimed rewards.

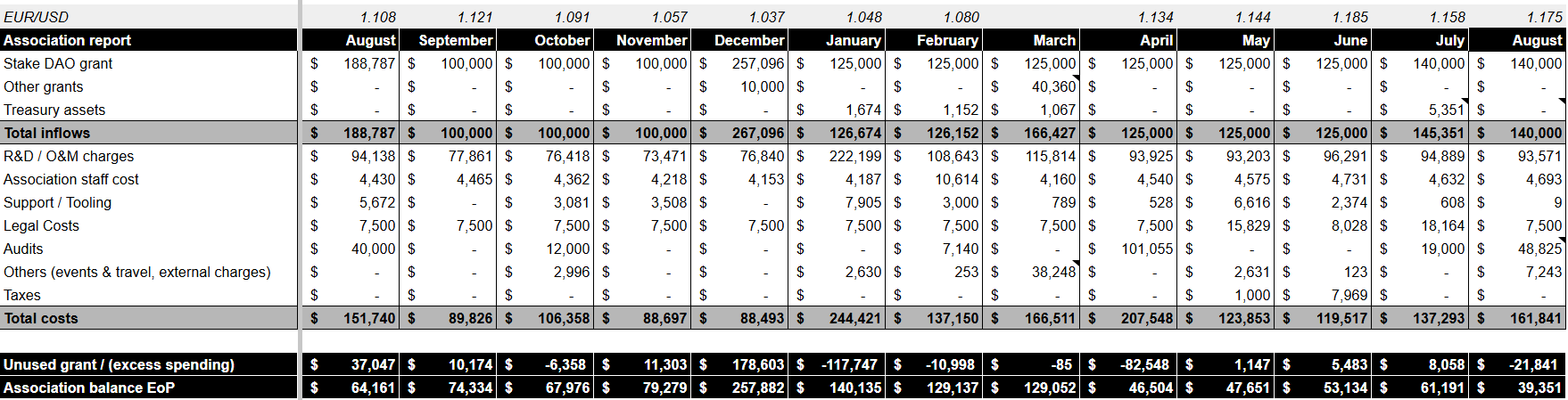

Association grant use report

Two audits were paid this month, as well as a one year subscription to Hypernative, leading to a 21k deficit for the Association this month.

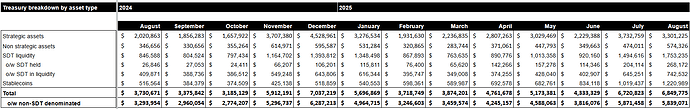

Comprehensive view

Following the continued performance of the DAO over the past months, the treasury started to buyback some SDT, and acquired 73,403 SDT for a total of 35,166 USDC. Furthermore, $56k of fees were distributed to veSDT this month. The cumulative output from the start of the year exceeded $2m on aggregate, as July reached a near ATH performance at $427k, while costs increased due to exceptional costs in August.

Legal & governance

August retrospective

- Proposal to allow the acquisition of more veCRV boost by the DAO

- Signed and executed the contract with Hypernative

Focus for September

- SDGP 58 has been pushed by a community member and will go through a governance vote.

- Transfer of socials’ accounts and missing legacy Foundation funds to Stake DAO Association

Disclaimer

The Stake DAO Association acts strictly in an execution-only capacity, pursuant to mandates adopted by the DAO through governance processes. The Association does not provide investment advice, does not engage in asset management on its own account, and assumes no ownership or custody over DAO treasury assets. Any contracts, payments, or services facilitated by the Association are executed solely as administrative and operational support for the DAO, and shall not be construed as creating legal or financial liability of the Association beyond such execution. The Association expressly disclaims succession to any past entity or foundation, and no assumption of legacy liabilities is intended or implied.