Highlights

- Solid growth on both strategies and Votemarket

- Most profitable month of the year

Product (Strategy/Smart contracts/UI/Development)

December retrospective

- Fixed some VMv2 and stakedao.org UI / back-end bugs and performed several improvements

- Enabled vlCVX delegation

- Updated PancakeSwap’s gauge controller

- Gnosis Safe app development for VMv2

- Distributed the Top Cake rewards

- Progressed on “Staking v2” design

- BAL vestor shipped and used

- Fixed an issue with CCIP’s fee buffer which was consuming too much gas

Focus for January

- Audit the ZeroLend locker

- Migrate the APW locker

- Progress on Staking v2

- Start distributing Spectra vote incentives

- Expecting one or two new PancakeSwap IFOs

- Setting up a new emergency shutdown framework to increase our security in case of attack

Business development

December retrospective

- Converted VMv2 users from veCRV-only to veCRV+vlCVX campaigns, leading to $400k weekly deposits

- Aladdin started voting on Votemarket bribes with 2m vlCVX (~20m veCRV), leading to better efficiency than on Votium

- Filled the Morpho grant application

- Some Balancer Maxis started receiving their salaries in sdBAL

- Solid growth of Stake DAO’s strategies:

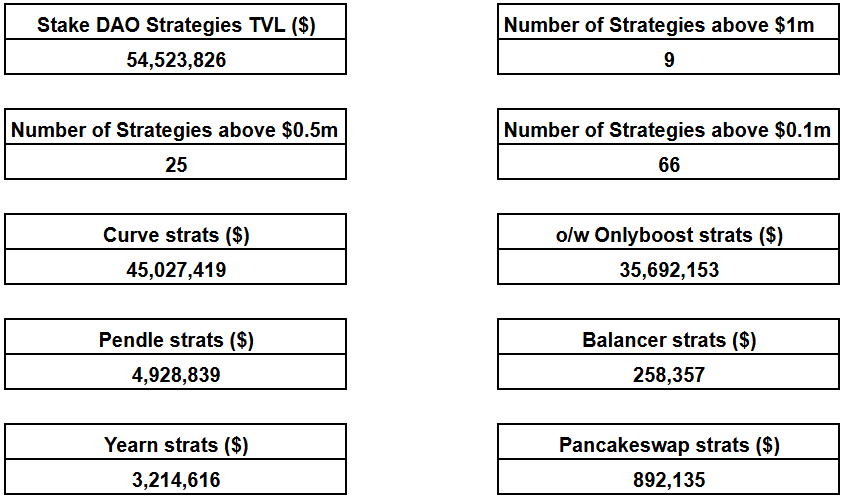

- Total TVL in strategies: $55m (+$10.5m / +24% MoM)

- Onlyboost TVL: $36m (+$10.4m / +41% MoM)

- Number of strategies above $500k: 25 (+7 / +39% MoM)

Focus for January

- Close a second deal with vlCVX vote delegation

- Launch the delegation reward program

- Prepare the ZeroLend locker launch

- Prepare for two new PancakeSwap IFOs

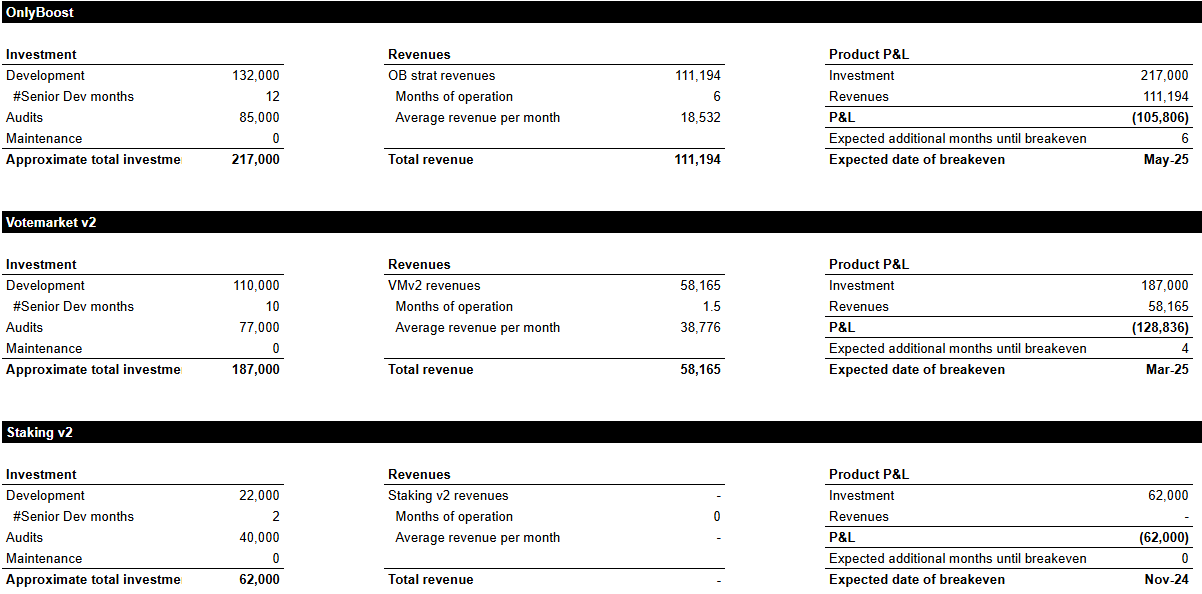

Product investment performance tracking

Financials

Stake DAO treasury : https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063

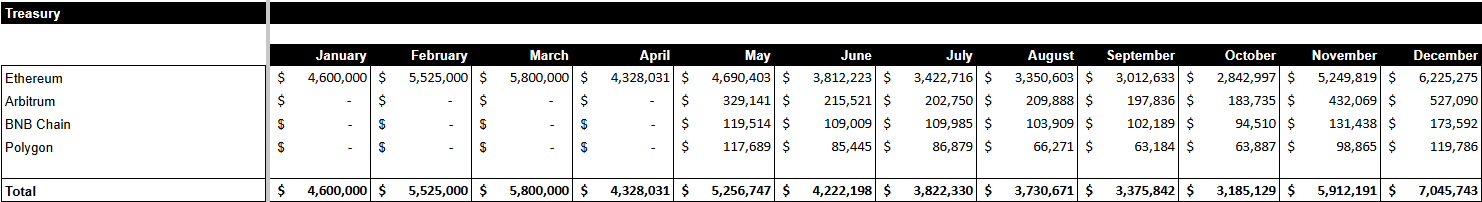

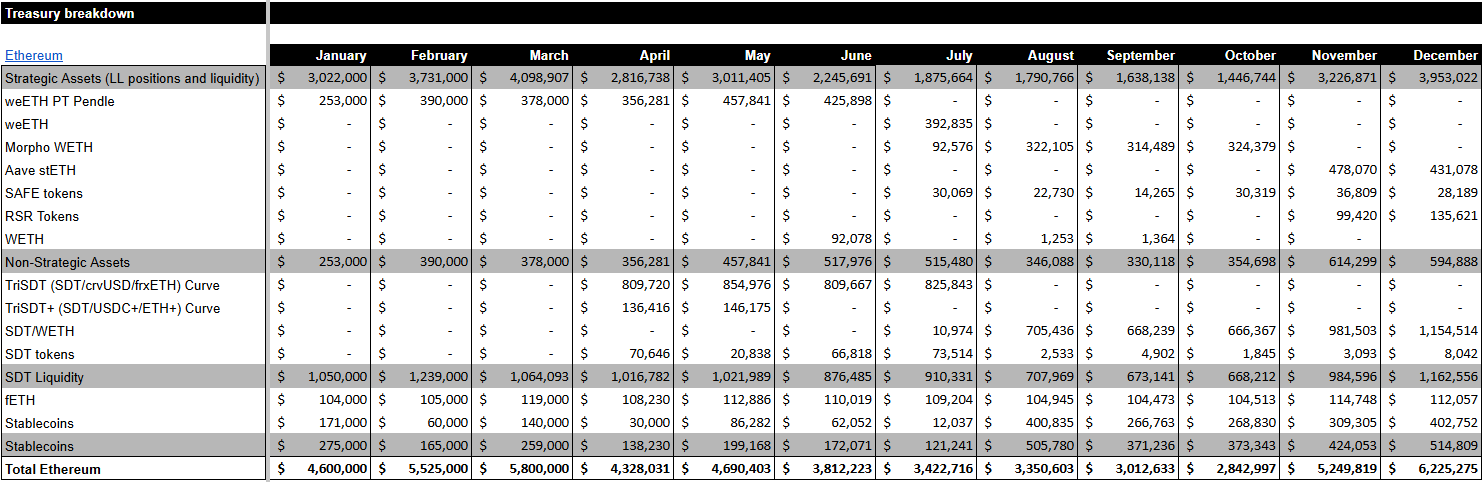

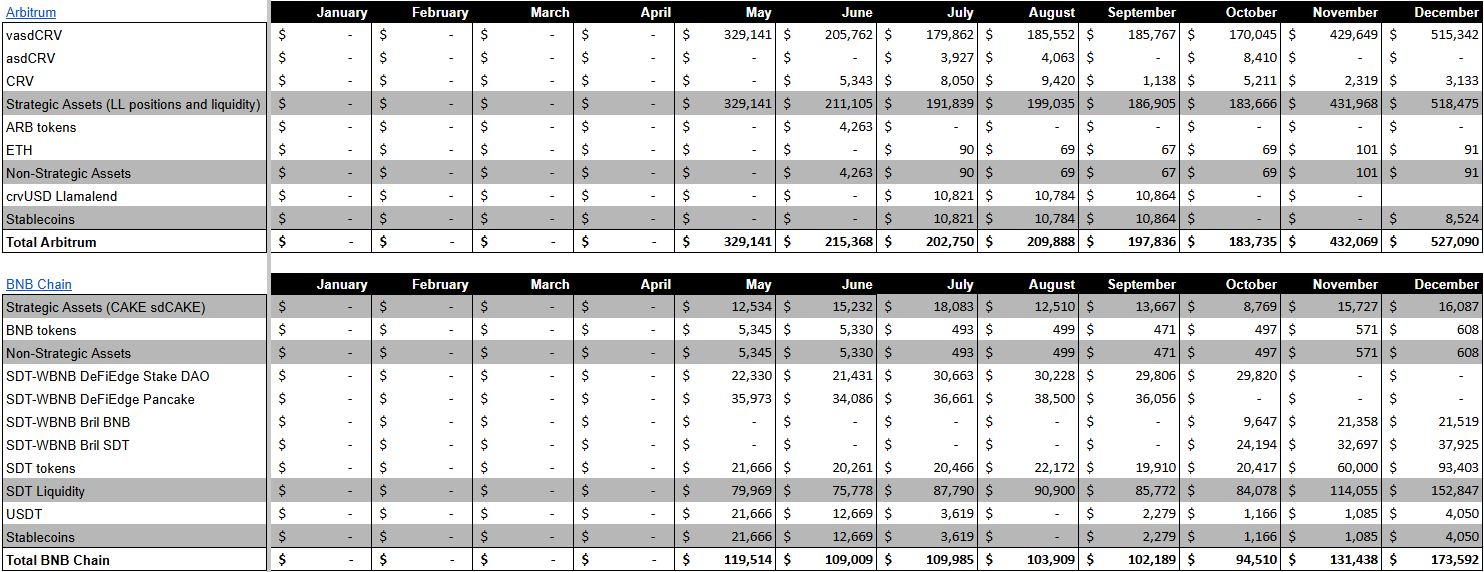

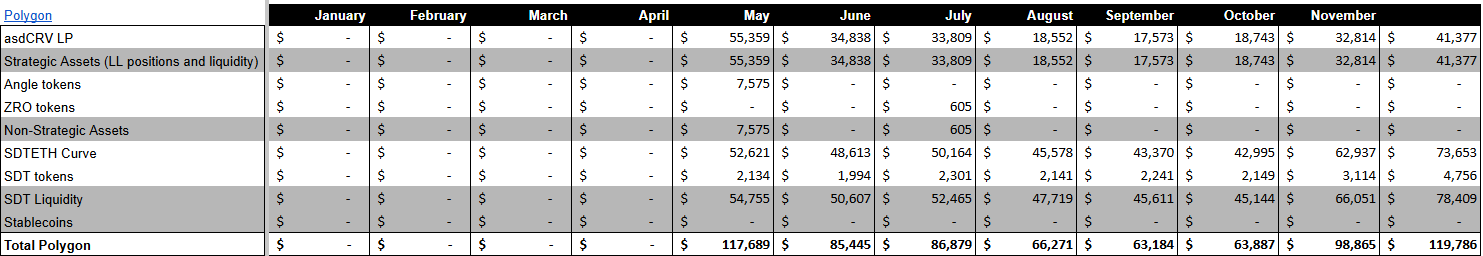

The treasury saw a steep increase this month following market increase and higher revenues.

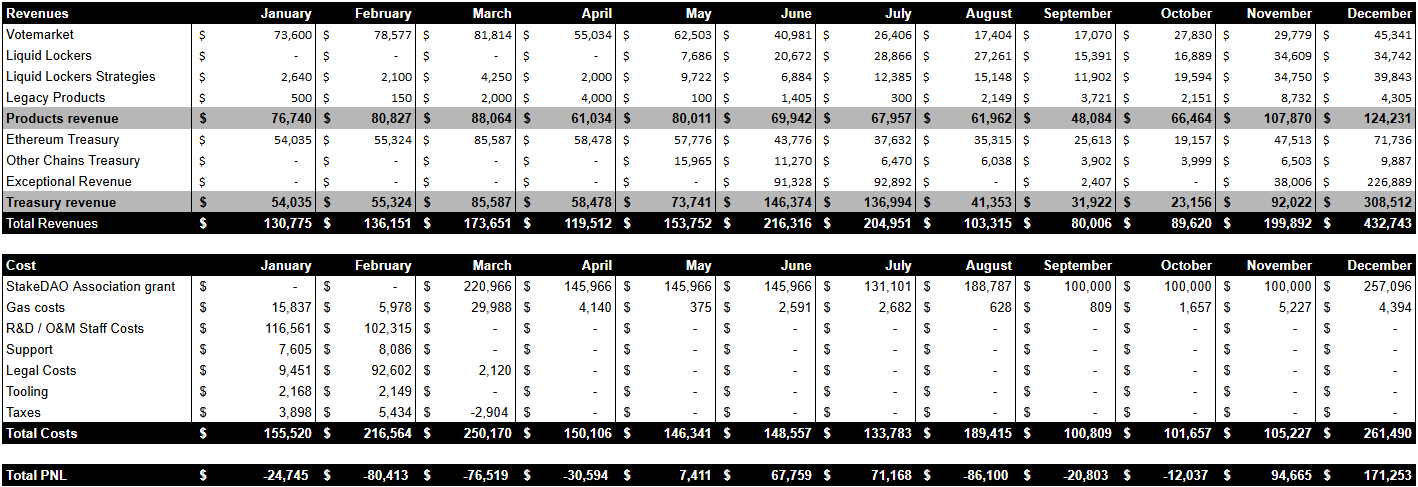

P&L

December was the most profitable month of the year, which is giving us a positive net profit in 2024, standing at $81k, $338k if we account for StakeDAO Association’s unspent grant. The increase of TVL in strategies led to an increase in Strategies revenue. The increase of revenues of Curve, Yearn and Pendle led to an increase in revenues for the Lockers. Votemarket v2 ramp up grew by 50% in December, to reach a monthly revenue that hadn’t been seen since May.

The overall net profit for the month is $171k, but $350k if we retreat for the unspent grant amount.

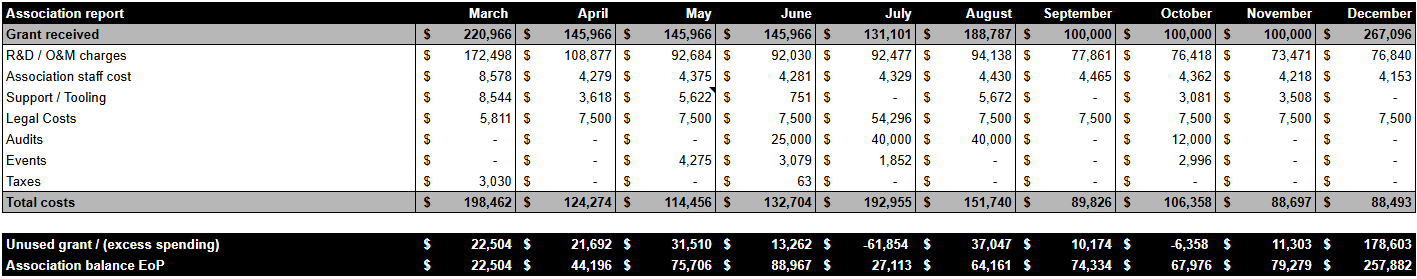

Association grant use report

The Association saw its lowest historical costs, leading to an overall profit of $106k net profit for the DAO in November.

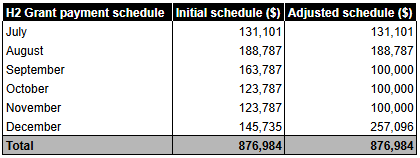

As detailed in past reports, some payments from previous months have been delayed to December which explains the higher than usual grant payment. A 10,000 USDC grant was also received from ZeroLend to develop a locker for their project.

Legal & governance

December retrospective

- vlCVX delegation incentivisation proposal

Focus for January

- Proposal to accept ownership of the ZeroLend locker

- Proposal to stop relocking of sdANGLE and sdAPW proposed by community

- Grant request for H1-25

- Transfer of twitter account