Highlights

- 11% of Curve’s inflation going through Stake DAO strategies (ATH)

- Steady revenues in a lower market environment

Product (Strategy/Smart contracts/UI/Development)

January retrospective

- Staking v2 specs definition

- Listapie and Solv IFO

- Spectra vote rewards automated distribution

- Brought forward vlCVX vote rewards distributions on Thursdays

- Fixed several bugs, and developed the automation of processes

Focus for February

- Zerolend locker finished and audited

- Develop the SPECTRA locker

- Start the development of Staking v2

- Balancer VMv2

Business development

January retrospective

- Delegation reward program brought 300k vlCVX delegated to stakedao-delegation.eth on the first round

- Increased share of Aladdin votes for VM bribes

- ATH share of Curve inflation going through Stake DAO strategies, notably driven by a BD push on the AIOZ/WETH strategy: 10.60%, representing $1m of annual revenues at a CRV price of $0.8

- Development of the institutional BD, with a partnership with a private traditional fund manager that will use exclusively Stake DAO strategies (test amount of $15k deposited)

- Reached 200k veBAL

- Sharp increase in Yearn strategies TVL

- Flat TVL on Stake DAO’s strategies, but a shift towards more profitable ones:

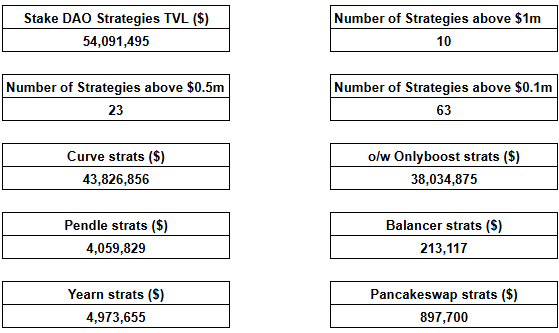

- Total TVL in strategies: $54m (-$0.5m / -0.8% MoM)

- Onlyboost TVL: $38m (+$2m / +6.5% MoM)

- Number of strategies above $1m: 10 (+1 / +11% MoM)

- Yearn strategies TVL: $5m (+$1.8m / +55% MoM)

Focus for February

- Close a second deal with vlCVX vote delegation

- Prepare the ZeroLend locker launch

- Partnership with Resolv to push Stake DAO strategies

- Trying to get Resolv to use Stake DAO strategies for their backing

- Defend Morpho grant request

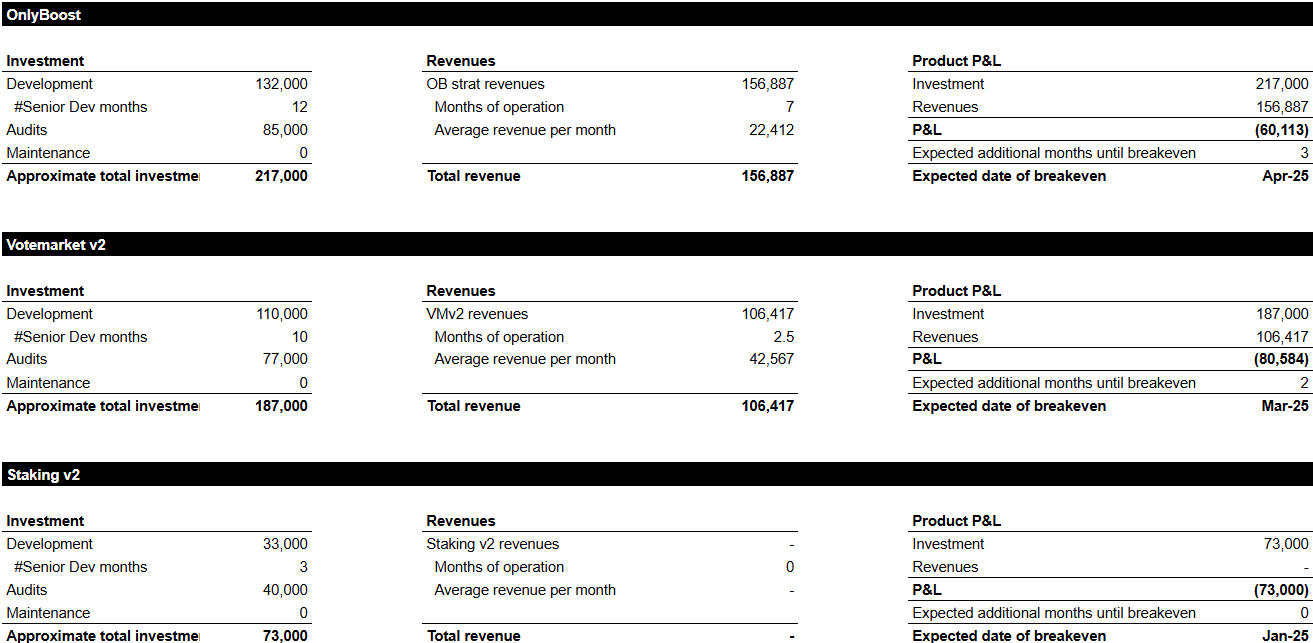

Product investment performance tracking

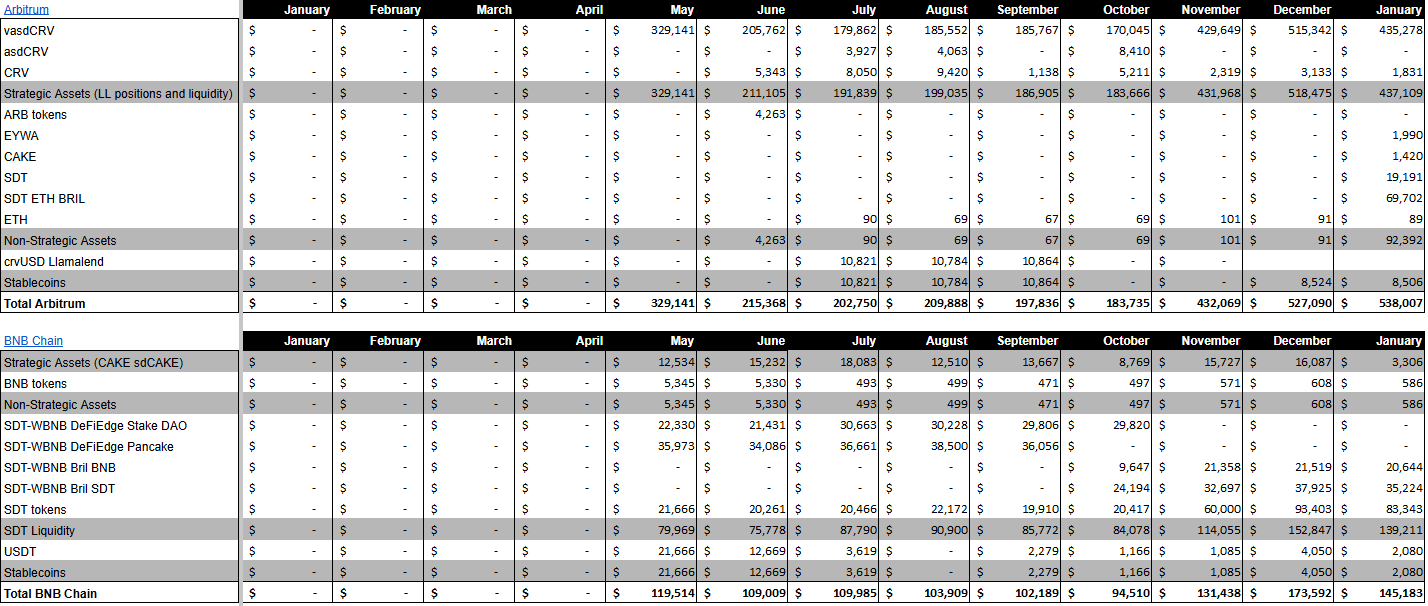

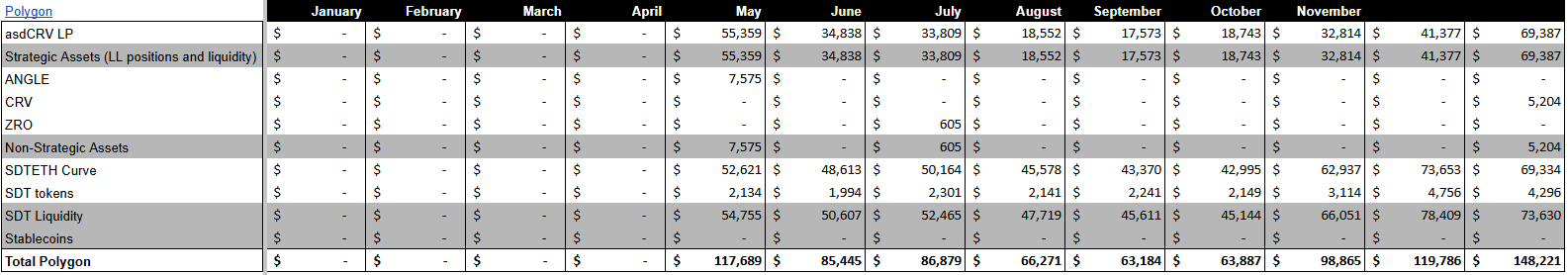

Financials

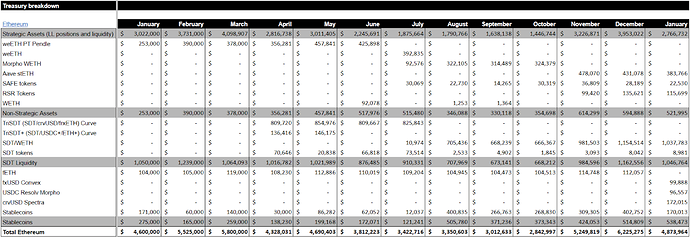

Stake DAO treasury : https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063

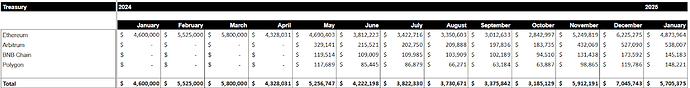

The treasury saw a steep decrease this month following the market downturn.

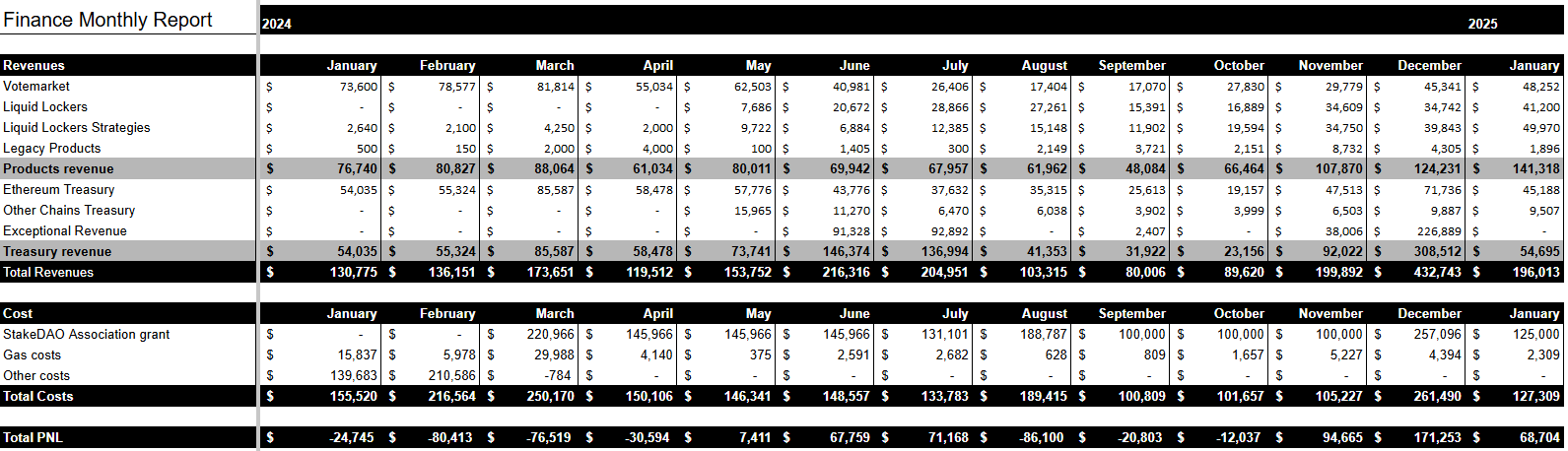

P&L

Steady recurring revenue in January, despite market downturn, explained by a steady growth in all business lines, especially in Onlyboost revenues (+36% MoM) offset by a decrease in treasury revenues.

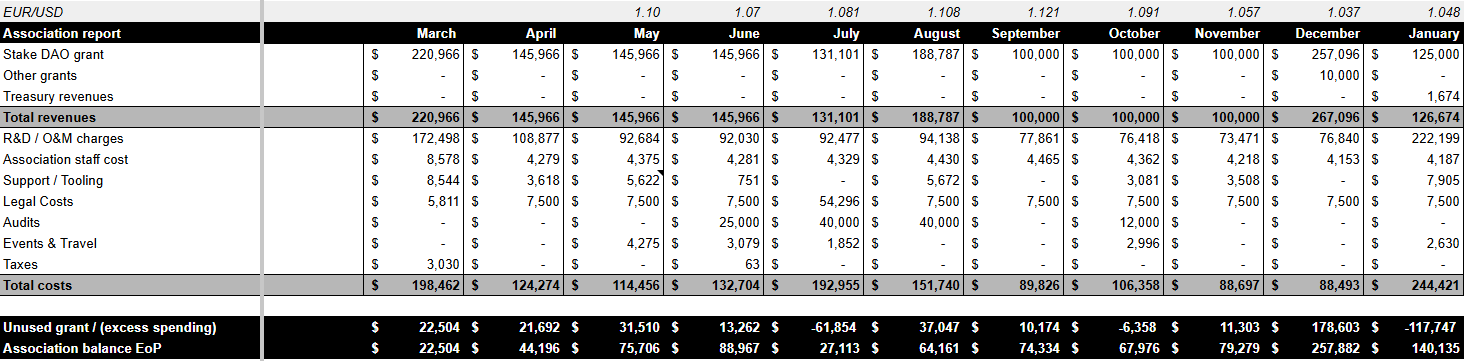

Association grant use report

Bonus payment explains the increase in R&D / O&M charges in January.

Legal & governance

January retrospective

- Updated terms and conditions’ and requested approval to connect to the UI

- H1-25 grant request passed guaranteeing continued support to Stake DAO for the next six months

Focus for February

- Update privacy and cookie policies

- Proposal to accept ownership of the ZeroLend locker

- Transfer of twitter account