Highlights

-

Staking v2 deployed on main relevant L2s for Curve and experiencing great traction

-

Surge in TVL reaching $300m for the first time

-

Very good results for the DAO (second largest inflows since December ATH which was led by important exceptional inflows)

-

Passed 3.5m vlCVX delegated to stakedao-delegation.eth, while incentives were stopped

Product (Strategy/Smart contracts/UI/Development)

July retrospective

-

Staking v2 was released on most relevant L2s for Curve

-

Shipped Staking v2 UI and general UI update

-

Launched the Votemarket vote optimiser

-

Staking v2 Morpho markets gone to audit

-

Audit of asdPENDLE SY contract passed

-

asdPENDLE Pendle market launched

Focus for August

-

Shipping Staking v2 on Ethereum for Curve

-

Launching Morpho markets using Staking v2

-

vePENDLE Votemarket

-

Select vault infrastructure for vaults built on top of Staking v2 strategies

Business development

July retrospective

-

Massive traction for Stake DAO strategies, leading to a new total TVL ATH at $300m

-

This is notably due to the launch of Staking v2 strategies on side chains which gained immediate traction and reached $12m in the first week.

-

Stake DAO’s TVL on side chains surged to $14.6m.

-

Stake DAO remained in charge of maintaining the TAC liquidity campaign, and therefore retained the large TVL in TAC strategies

-

Word of mouth and v2 launch, supported by a favorable market across the board and net inflows in DeFi put all indicators in the green zone in July, with notably $55m added to Stake DAO strategies.:

-

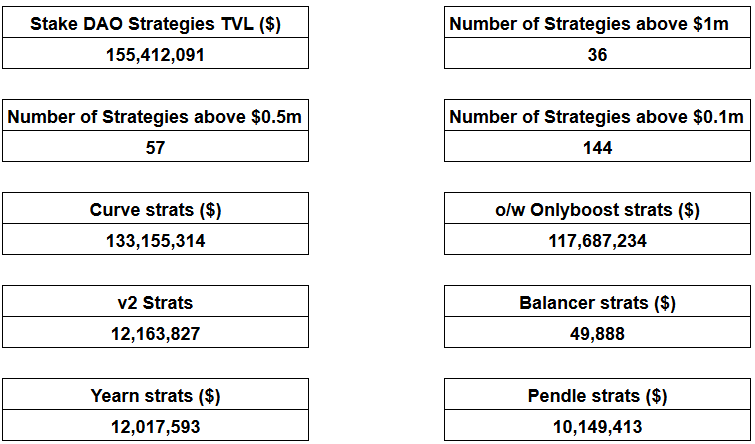

Total TVL in strategies: $155.4m (+$55m / +54% MoM)

-

Onlyboost TVL: $117.7m (+$41.2m / +54% MoM)

-

v2 strategies TVL: $12.1m

-

Number of strategies above $1m: 36 (+8 / +33% MoM)

-

Number of strategies above $0.1m: 144 (+48 / +50% MoM)

-

Yearn strategies’ TVL: $12.0m (+$2.3m / +24% MoM)

-

Pendle strategies’ TVL: $10.1m (+$2.3m / +29% MoM)

-

Focus for August

-

Secure commitment from key curators to curate on Stake DAO

-

Secure an agreement with Resolv for a partnership regarding stRESOLV liquid wrapper provision

-

Engage talks with Nexus mutual for a dedicated cover deal for Stake DAO vaults

Financials

Stake DAO treasury : https://debank.com/bundles/131411/accounts

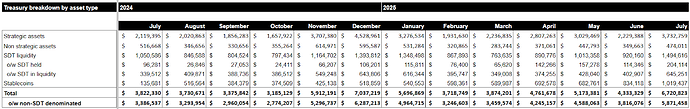

Supportive market and CRV price action, followed by strong results for the DAO, led to higher treasury on July 31st, as we passed the $1m in stable coins, and reach $1.5m in non-strategic assets.

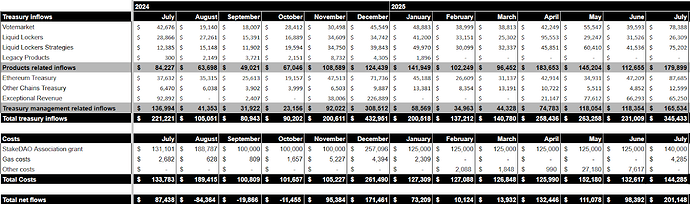

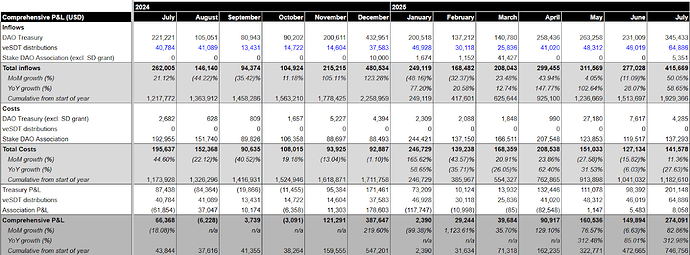

Net treasury cash flows

The strong market trend and CRV price action, supported by the very solid development of Stake DAO strategies, led to a steep increase in Votemarket and Strategies output, as well as an increase in treasury inflows in July which reached it’s second highest mark ever, after December 2024 which was mainly driven by exceptional inflows.

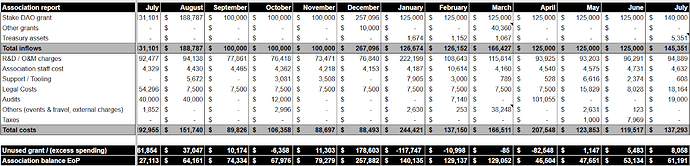

Association grant use report

In July, the costs of the Association which included $19k of audits were fully covered by the grant. The Association sold its 5000 MORPHO grant materialising a $5,351 profit.

Comprehensive view

$65k of fees were distributed to veSDT this month marking an ATH. The cumulative output from the start of the year is closing in on $2m on aggregate, as July reached a near ATH performance at $415k, while costs stayed in line with the historical trend.

Legal & governance

July retrospective

- StakeDAO Association grant request for H2-25 was accepted

Focus for August

-

Engaging Hypernative for security services

-

Transfer of socials’ accounts and missing legacy Foundation funds to Stake DAO Association