Highlights

- Staking v2 deployed on Fraxtal as a test

- Contributor annual brainstorming week took place to define the roadmap for 2025-26

- Resupply hack lead to a loss in TVL but not a loss in fee generation

Product (Strategy/Smart contracts/UI/Development)

June retrospective

- Worked on Staking v2 and released it on Fraxtal to test

- Worked on Staking v2 UI

- Did a whole security review of the DAO to identify security improvement opportunities

- Yieldnest locker is now fully live

- Created a standard collaboration framework with Merkl to deploy boosted strategies on for projects using Merkl distribution (Zerolend, YieldNest and Spectra so far)

Focus for July

- Shipping Staking v2 on all chains for Curve

- Auditing Morpho markets using Staking v2

- asdPENDLE integration on Pendle

- Vote optimiser for Votemarket users

- vePENDLE Votemarket

Business development

June retrospective

- BD contributors went to ETH CC in Cannes, connecting the dots to support the DAO in the next step of its growth towards retail and institutional adoption. They notably met with top tier curators and distributors who committed to or showed interest in using Stake DAO staking v2 strategies

- The sdBAL locker also grew by 7%, exceeding 350k veBAL

- The proposal to allow boost delegation on Balancer was passed and the boost delegation can now move forward

- sdYND reached 16m veYND, representing 32% of the veYND supply

- Managed to bring c.$30m of TVL to TAC pools, showing the strength of Votemarket’s liquidity bootstrapping platform

- The Resupply hack had a strong impact on the DAO’s TVL, as 2 of the biggest Stake DAO strategies had reUSD involved. However, the share of Stake DAO in the total pool’s TVL didn’t decrease, so the loss in TVL didn’t impact the DAO’s fee generation:

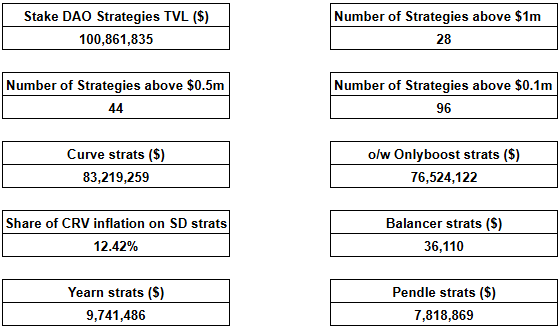

- Total TVL in strategies: $100.9m (-$8m / -7% MoM)

- Onlyboost TVL: $76.5m (-$9m / -11% MoM)

- Share of CRV emissions going through Stake DAO strategies: 12.4%

- Number of strategies above $1m: 28 (+1 / +4% MoM)

- Number of strategies above $0.1m: 96 (+3 / +3% MoM)

- Yearn strategies’ TVL: $9.7m (+$0.1m / +1% MoM)

- Pendle strategies’ TVL: $7.8m (+$1.1m / +17% MoM)

Focus for July

- Secure commitment from key curators to curate on Stake DAO

- Engage talks with Nexus mutual for a dedicated cover deal for Stake DAO vaults

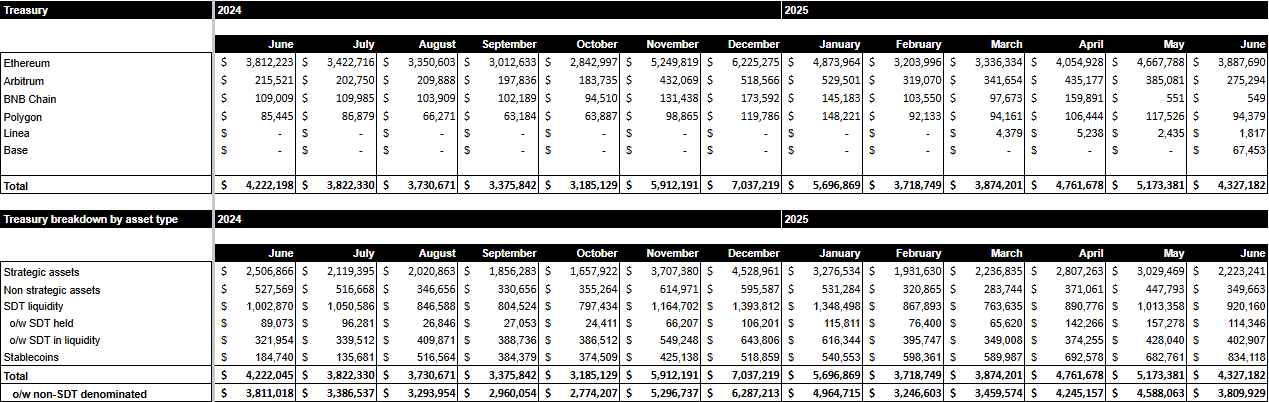

Financials

Stake DAO treasury : DeBank | Your go-to portfolio tracker for Ethereum and EVM

Market downturn and CRV price action lead to lower treasury on June 30th.

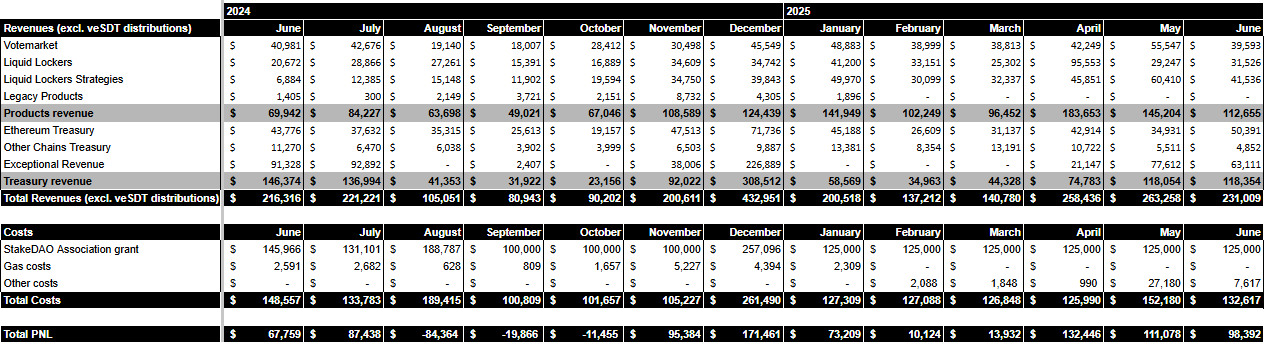

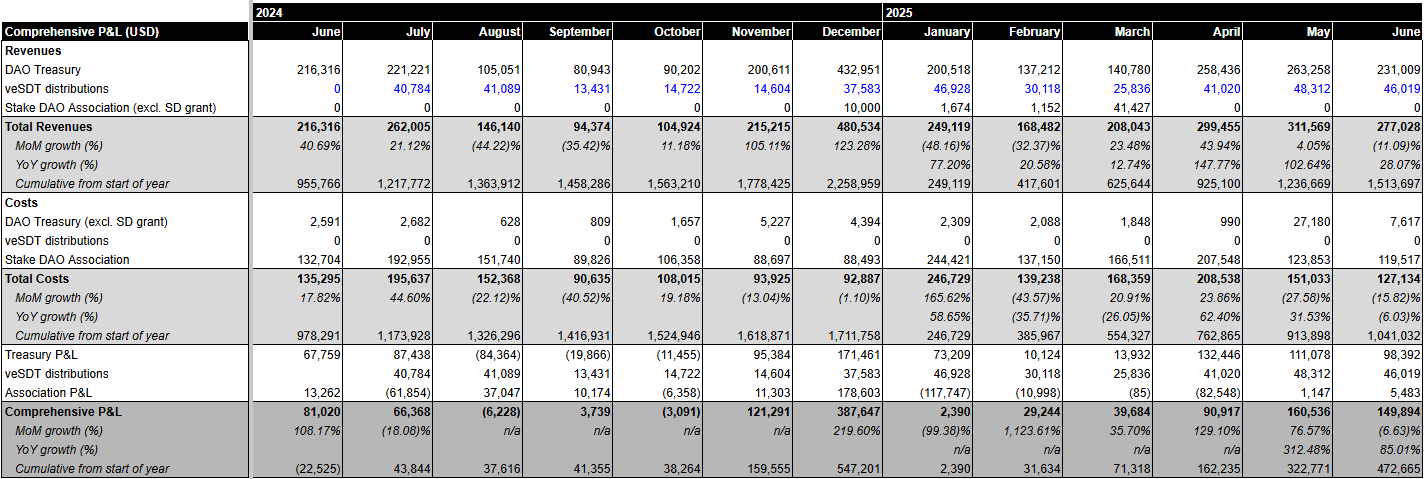

P&L

Slight decline in farming and CRV denominated outputs in June, mainly due to the drop in market prices. The DAO still managed to outpace its costs by nearly $100k.

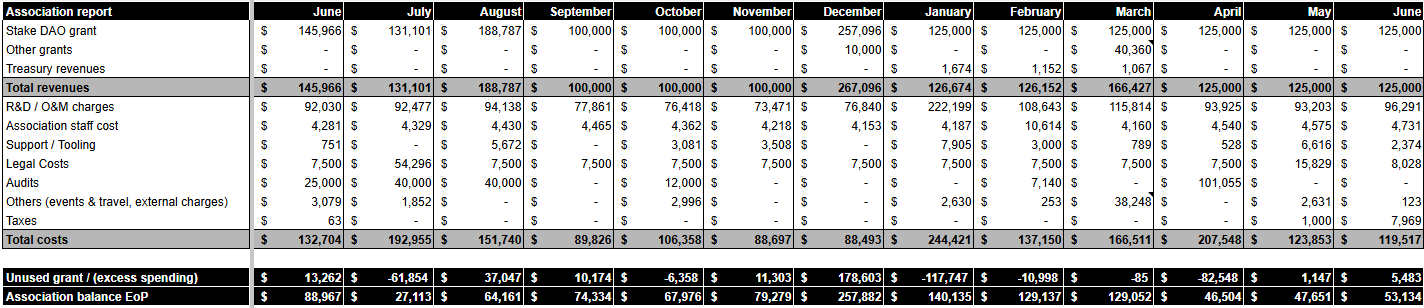

Association grant use report

In June, the costs of the Association were fully covered by the grant. The growing dynamic on the EUR/USD pairing is not helping as most of the costs are denominated in Euro, which gained more than 14% this year.

Comprehensive view

$46k of fees were distributed to veSDT this month. The cumulative output from the start of the year reached $1.5m on aggregate.

Legal & governance

June retrospective

- Accepted ownership and migration of strategies towards Staking v2

Focus for July

- vlSDT migration proposal

- Hypernative integration proposal

- Transfer of socials’ accounts and missing legacy Foundation funds to Stake DAO Association