Highlights

- New staking infrastructure sent to audit

- Deployed a locker factory

- Zerolend locker launched

- Votemarket v2 veBAL and veFXN shipped

- 2m vlCVX votes delegated

Product (Strategy/Smart contracts/UI/Development)

March retrospective

- Staking v2 sent to audit

- Deployed a locker factory

- Zerolend locker shipped

- Votemarket v2 for veBAL and veFXN shipped

- New page for vlCVX delegation, allowing reward forwarding, and managing Votium rewards

- Yieldnest locker deployed

- Automated gauge vote replication for on-chain gauge votes

Focus for April

- Develop the SPECTRA locker

- Work on Spectra strategies

- Staking v2 ready to be shipped

- Launch the Yieldnest locker

- Automations of new lockers’ maintenance

- sdANGLE redemption

Business development

March retrospective

Despite the challenging market environment, March was a very successful month in terms of business development.

- vlCVX vote delegation reached 2m vlCVX making Stake DAO the 7th largest voter on Convex

- Association received c.$40k of grants (from Binance, Morpho and ZeroLend)

- Reached 6% of veZERO supply in the first couple of weeks after the Zerolend locker launch

- Following its repeg, sdPENDLE locker grew by more than 600k sdPENDLE (+66% MoM), going from 900k to 1.5m vePENDLE

- The sdBAL locker also grew by 20%, exceeding 250k veBAL and 5% of the total veBAL supply

- Sharp increase in Yearn strategies TVL going to $7.8m from $3.8m (+105% MoM)

- For the first time in Stake DAO’s history, we passed the symbolic bar of 100 strategies above $100k

- Challenging markets were not enough to offset the growth in OnlyBoost strategies on Curve, and in overall Stake DAO strategies:

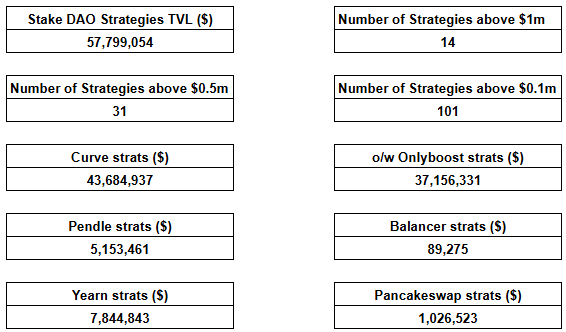

- Total TVL in strategies: $57.8m (+$9.2m / +19% MoM)

- Onlyboost TVL: $37.2m (+$5m / +16% MoM)

- Number of strategies above $1m: 14 (+3 / +27% MoM)

- Number of strategies above $0.1m: 101 (+25 / +33% MoM)

- 24.5% of Stake DAO strategies TVL doesn’t come from Curve

Focus for April

- asdPENDLE launch

- Keep working on Tetu boost delegation (currently blocked by technical issues on Balancer side)

- Push the reUSD strategies (main recipient of CRV inflation)

- Find a way to benefit from TAC’s chain bootstrapping

- Grow the ZERO locker

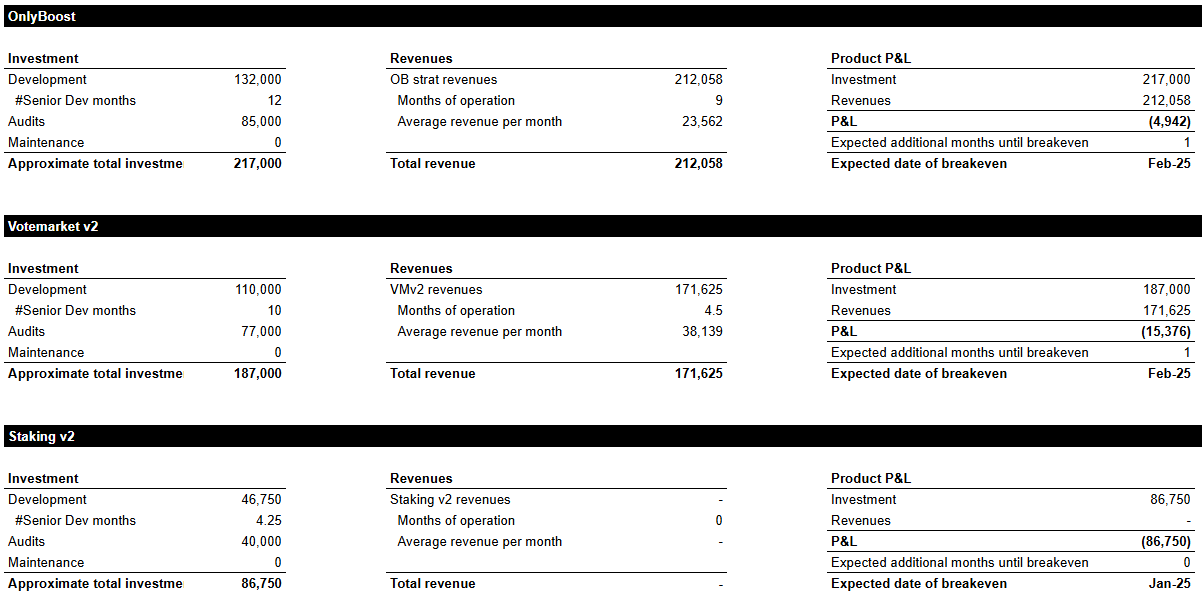

Product investment performance tracking

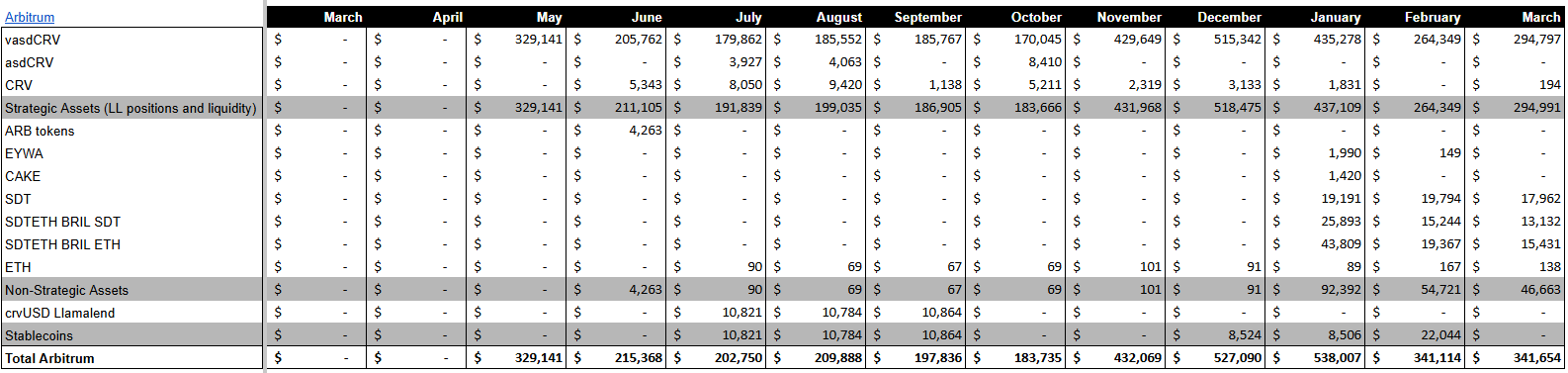

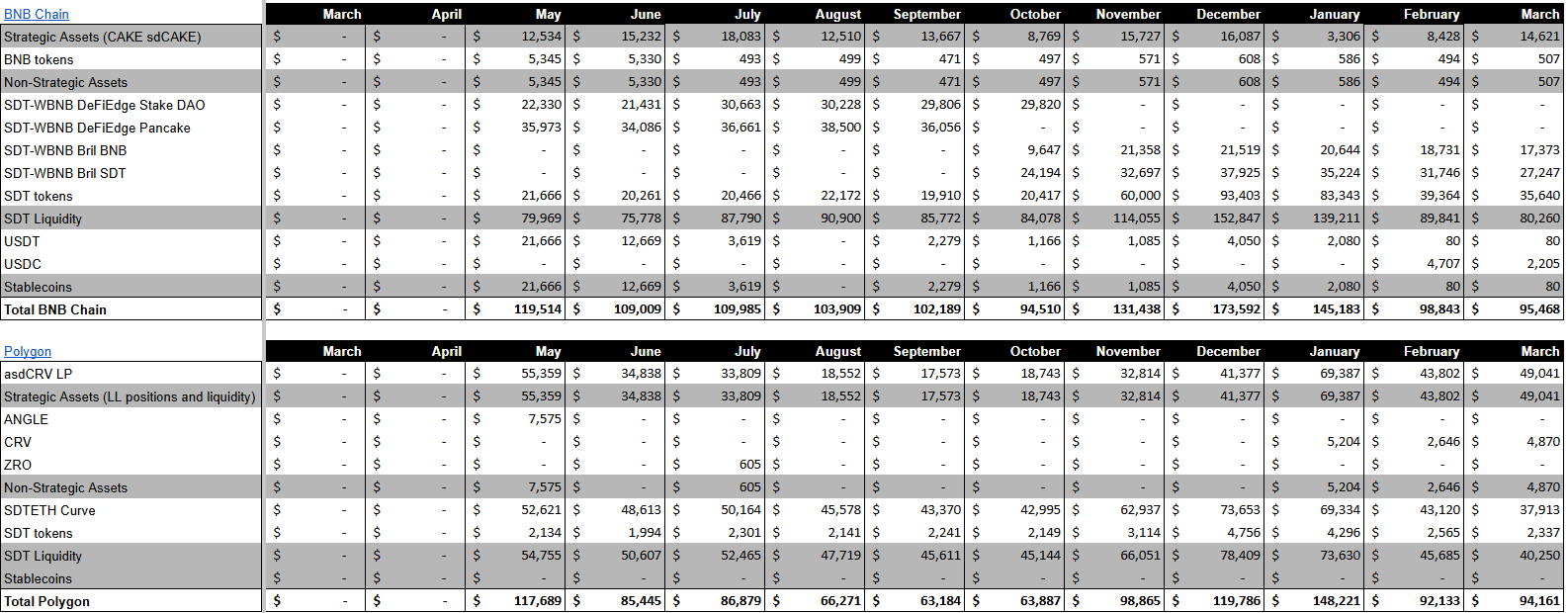

Financials

Stake DAO treasury : https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063

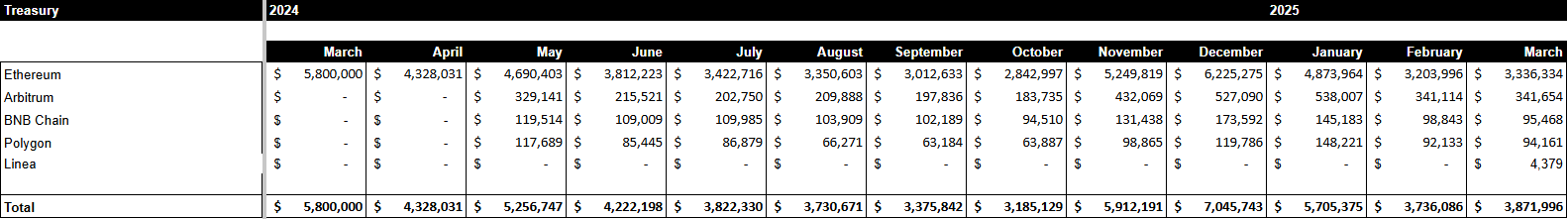

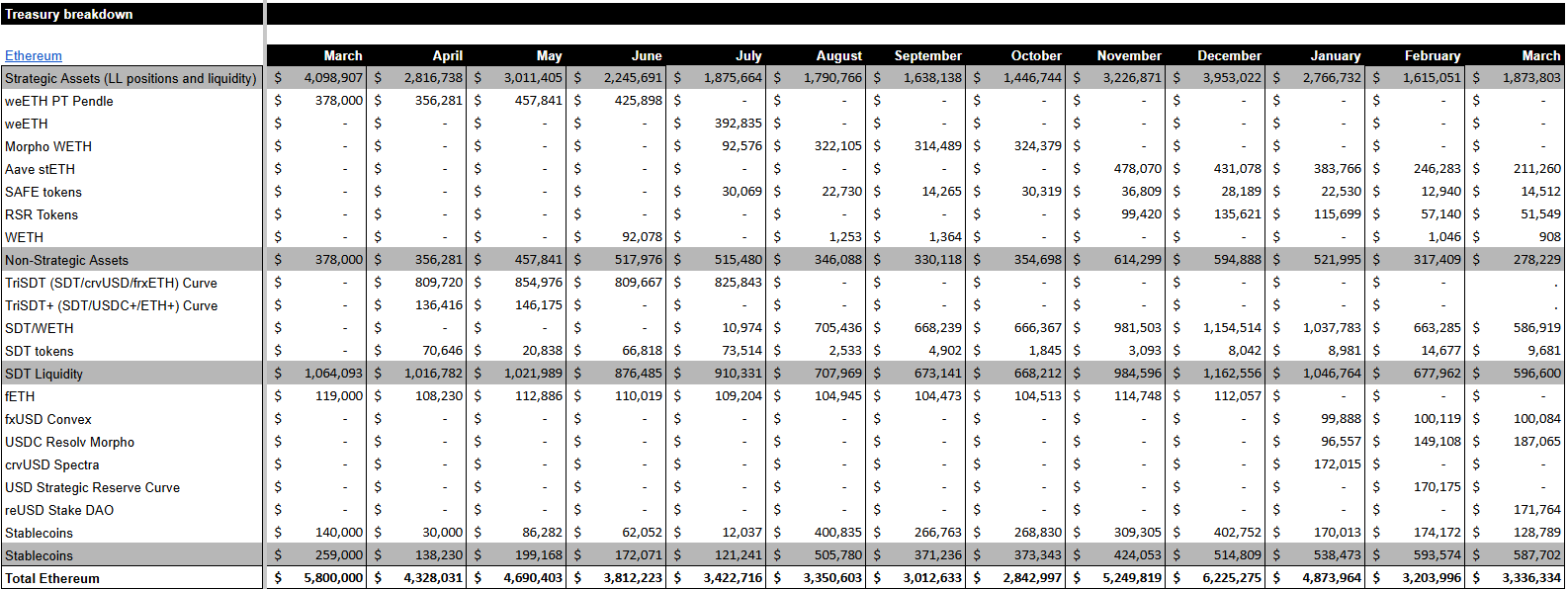

Despite market turmoil, the relative resilience of CRV allowed the treasury to keep a flat performance over the month.

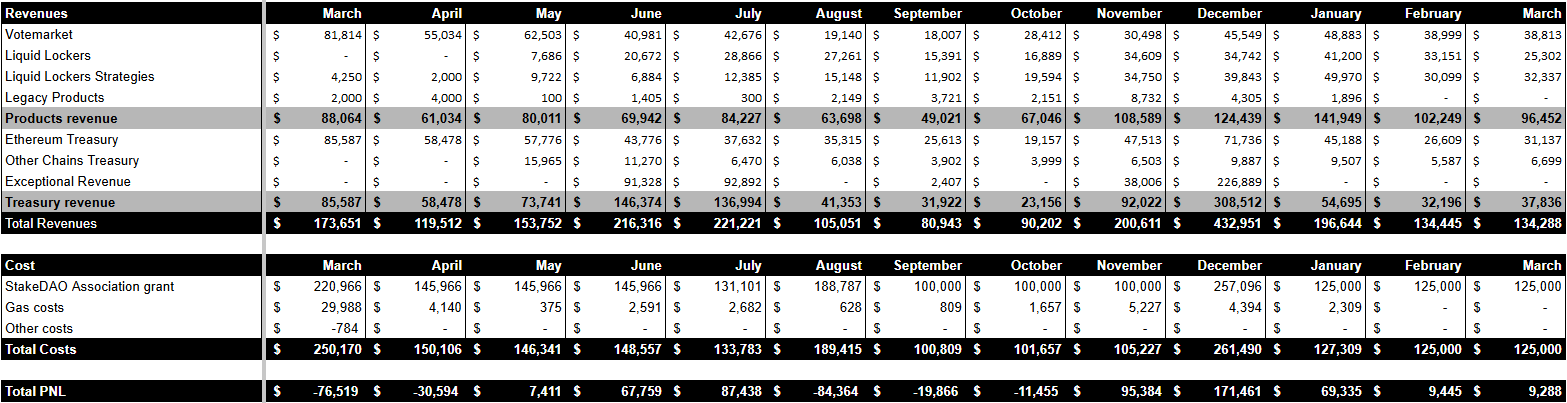

P&L

Revenues and costs for the DAO remained very consistent this month, scoring the same revenues and net profit as for February, despite the challenging market situation. A relative underperformance of the liquid locker division was offset by the strong performance of Stake DAO strategies and treasury management.

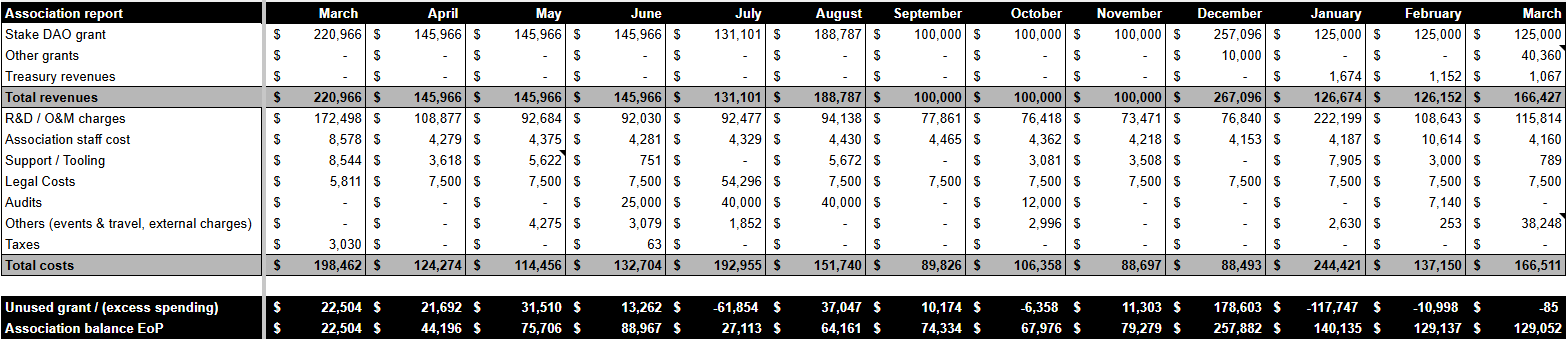

Association grant use report

Some exceptional spending (c.$38k coming from annual accounting and recruitment expenses) were offset by the receipt of three grants this month, from Morpho, ZeroLend and Binance.

Legal & governance

March retrospective

- sdANGLE proposal passed

- Redemption proposal for old rescued renBTC was passed

Focus for April

- New proposal to clean the legacy merkel claim infrastructure

- Managing the PancakeSwap situation

- Transfer of socials’ accounts and missing legacy Foundation funds to Stake DAO Association