Highlights

- YB liquid locker successful launch, and deployment of YB Votemarket

- Staking v2 saw massive success following new vote incentives on crvUSD pegkeepers

Product (Strategy/Smart contracts/UI/Development)

November retrospective

- Launched Etherlink chain for Curve

- YB Votemarket

- YB liquid locker

- Ability to set allocations manually and withdraw them when necessary on Onlyboost

- New hook for Votemarket to deposit unspent rewards as direct extra-rewards in the Onlyboost gauge directly

- Documentation for Morpho markets and the Router

- Deployed selected Morpho markets

- Disabled Yearn strategies

- Bot to automatically rebalance Onlyboost vaults

- Several fixes and minor improvements

Focus for December

- Balancer Onlyboost and Staking v2

- vlAURA Votemarket

- New Onlyboost formula to take into account the current reward rate rather than boost optimisation

- Launch the first Morpho vault

- New Morpho market implementation for composability improvements

- Multi-chain deployment of the router

- Add new curated vaults to the UI in a specific section

Business development

November retrospective

- November was a challenging month market wise. ETH went from $3,872 to $2,800, suffering a 28% drop. CRV also took a hit, going from $0.48 to $0.39 (-19%). As a result, Stake DAO’s TVL in dollars went down. However it saw massive inflows following the surge in APR of peg keepers due to YB bribes, which led to a majority of deposits going through Staking v2 vaults. This mitigated the drop in strategies TVL which lost only 4%. Staking v2 strategies actually saw an increase in TVL despite the market drop

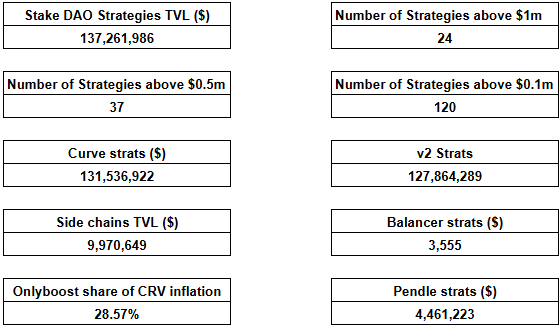

- Sign of the success of Staking v2: since it was deployed, the share of CRV inflation going through Onlyboost contracts went to 28.6% from around 12% before the deployement.

- Yearn strategies were deprecated

- $40k grant secured from Curve to help finance the development of an oracle for Curve LPs usable on Morpho

- YB locker successfully launched with 1.7m YB locked in the first few weeks

- Strong performance of the vlCVX delegation again, reaching >5m vlCVX delegated (+11%)

- Strong performance of the PENDLE locker again, going to 2.57m PENDLE locked from 1.89m (+36%), mainly driven by the performance of asdPENDLE and the fact that the liquidity scaling framework was put in place for sdPENDLE

- Total TVL in strategies: $137m (-$6.0m / -4% MoM)

- v2 strategies TVL: $127.9m (+$1.5m / +1%)

- Number of strategies above $1m: 24 (-6 / -20% MoM)

- Number of strategies above $0.1m: 120 (-23 / -16% MoM)

- Pendle strategies’ TVL: $9.6m (-$0.9m / -8% MoM)

Focus for December

- Launch and grow the Stake DAO curated vault

- Secure the Morpho grant once all milestones have been reached

- Attract large deposits in the YB locker

- Attract Balancer bribes

Financials

Stake DAO treasury : DeBank | Your go-to portfolio tracker for Ethereum and EVM

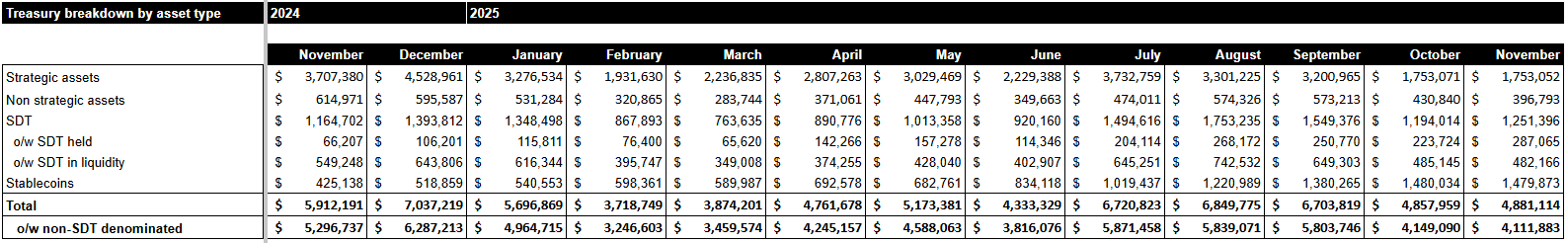

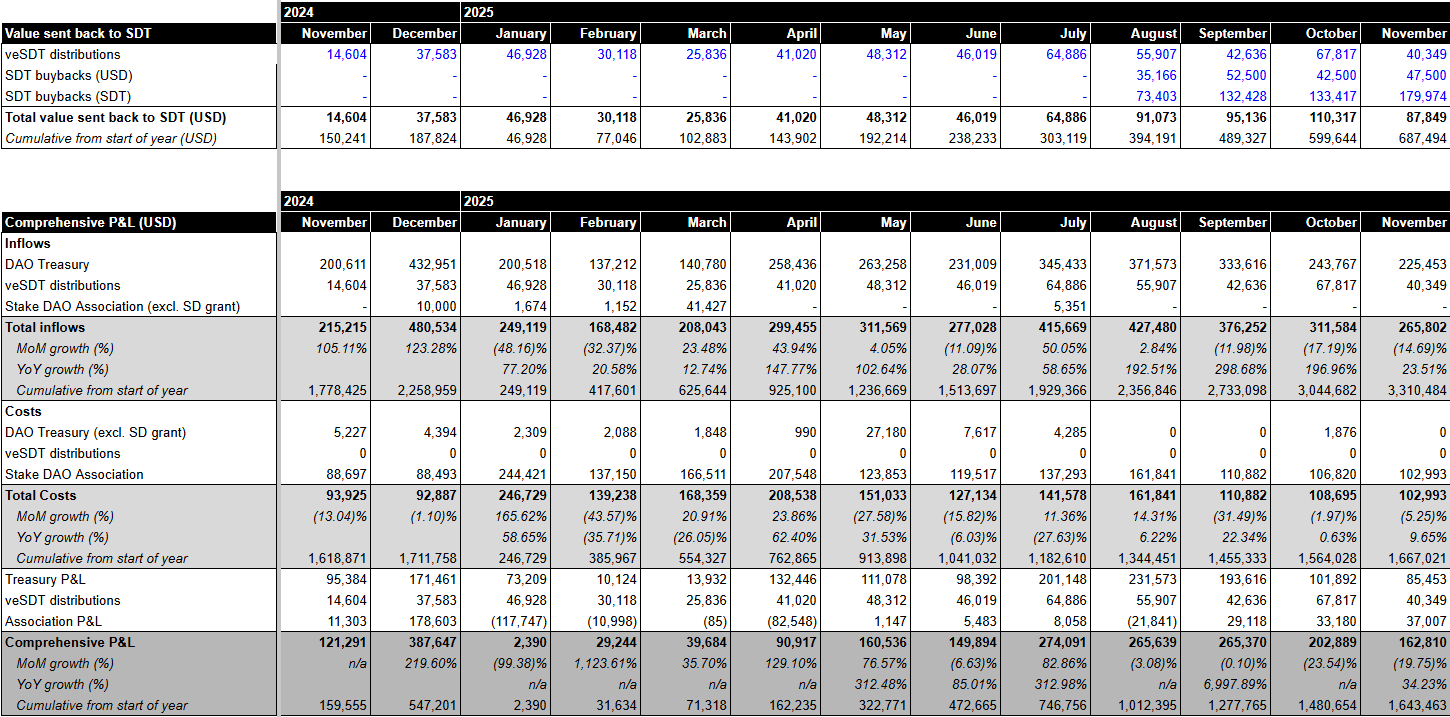

Treasury breakdown by asset type 2024 2025

The sharp market drop,was partially mitigated by revenues and treasury management. Also by the fact that the October snapshot was actually taken on November 4th, after an already sharp decline in market prices..

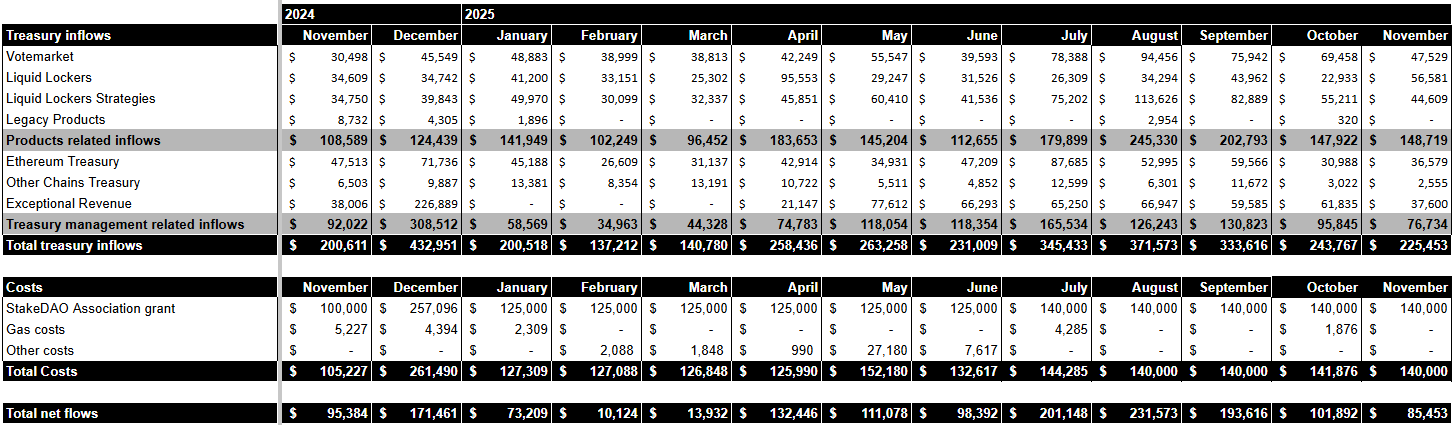

Net treasury cash flows

High revenues from the Pendle locker due to two airdrops being distributed led to an increase in locker revenue. The painful market, notably its impact on CRV price, led to a decrease in revenues of other business lines. Finally, Stake DAO received a $37.6k grant from Curve for developing oracles for Curve pools that could be used on Morpho.

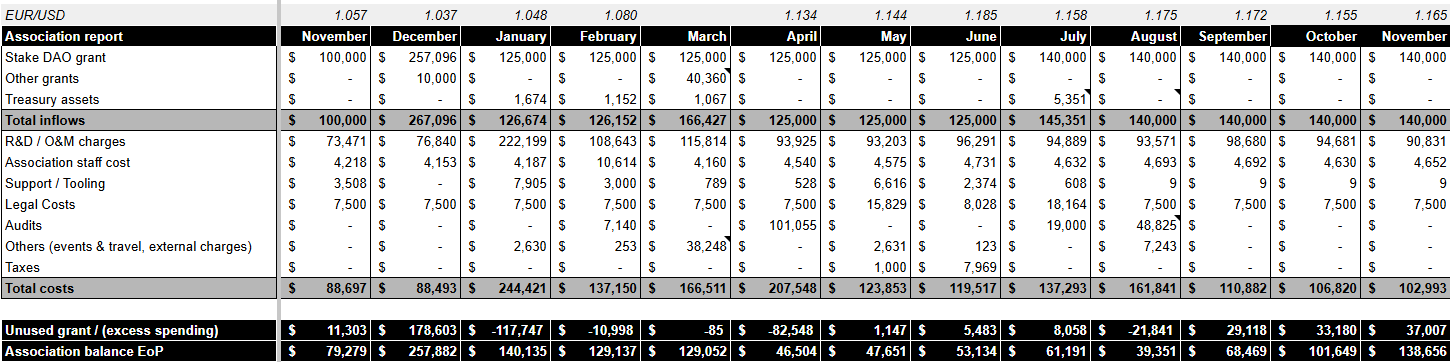

Association grant use report

No exceptional costs this month, leading to an unspent grant of $37k.

Comprehensive view

The drop in SDT price in November allowed the DAO to acquire another 180k SDT. Total cumulative net result over the year now exceeds $1.5m

Legal & governance

November retrospective

- SDGP-59 to shut down completely long term incentive emissions

- SDGP-60: incentivise the sdYB locker thanks to the reward pool

- SDGP-61: Strategic veBAL boost acquisition from Tetu

Focus for December

- Mica compliant whitepaper

Disclaimer

The Stake DAO Association acts strictly in an execution-only capacity, pursuant to mandates adopted by the DAO through governance processes. The Association does not provide investment advice, does not engage in asset management on its own account, and assumes no ownership or custody over DAO treasury assets. Any contracts, payments, or services facilitated by the Association are executed solely as administrative and operational support for the DAO, and shall not be construed as creating legal or financial liability of the Association beyond such execution. The Association expressly disclaims succession to any past entity or foundation, and no assumption of legacy liabilities is intended or implied.