Highlights

- Hypernative integration and security enhancement

- 95% of strategies’ deposits have migrated towards the new staking infrastructure, the remaining 5% have been identified

- OpenCover to allocate capacity for allowing users to insure themselves on Nexus Mutual

Product (Strategy/Smart contracts/UI/Development)

September retrospective

- Most of the month was focused on the Hypernative integration and several security enhancements

- Key contracts are now all governed by a 48h timelock

- Several UI improvements, automations and bug fixes

- vlCVX delegation’s distribution moved from crvUSD to scrvUSD

- Migrated the governance forum’s server

- Staking v2 analytics page

- Votemarket vote optimizer now also optimises with non-votemarket bribes

- Staking v2 added to DefiLLama

- Large overhaul of the DAO management page

Focus for October

- Launching Morpho markets using Staking v2

- Finishing the hyperactive integration and security upgrade

- New depositors deployed for sdTKN, to adapt from the Staking v2 migration

- New hook for Votemarket to deposit unspent rewards as direct extra-rewards in the Onlyboost gauge directly

- HYPE liquid locker

- Option to buy cover when depositing in a Stake DAO strategy live in the UI

Business development

September retrospective

- IPOR/LLamarisk vault launched a curated strategy on top of Stake DAO

- OpenCover accepted to allocate capital to allow Stake DAO users to insure themselves when using Stake DAO and the underlying protocols

- Strong performance of the vlCVX delegation, outperforming largely the Votium delegation

- Contributors attended Token2049 Singapore and developed good business development leads and curator commitments

- Migration towards Staking v2 happened smoothly and is 95% complete. The remaining $5m are distributed between a handful of wallets

- The end of veYFI and dYFI incentivised gauge led to a drop in Yearn strategies which is expected to continue.

- Furthermore, the market draw back in September impacted Stake DAO strategies’ TVL, as well as the end of the Sonic airdrop campaign which led to a decrease in side-chain TVL:

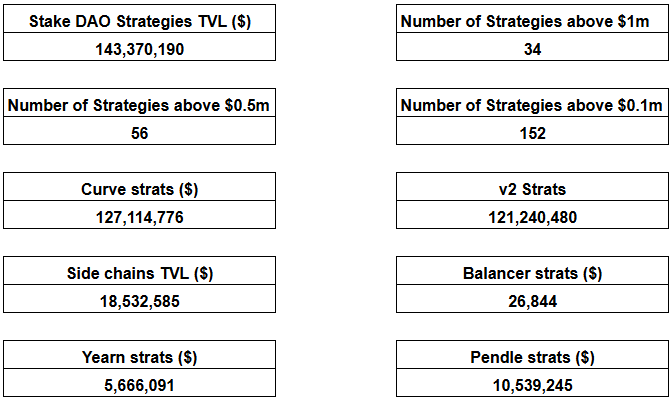

- Total TVL in strategies: $143.4m (-$14.1m / -9% MoM)

- Side chains TVL: $18.5m (-8.2$m / -31% MoM)

- v2 strategies TVL: $121.2m (+$14.0m / +116%)

- Number of strategies above $1m: 34 (-4 / -11% MoM)

- Number of strategies above $0.1m: 152 (-9 / +6% MoM)

- Yearn strategies’ TVL: $5.7m (-$8.3m / -60% MoM)

- Pendle strategies’ TVL: $10.5m (-$1.8m / -15% MoM)

Focus for October

- Secure commitment from key Morpho curators to allocate capital to Stake DAO markets

- Discussions with Usual regarding a USUAL locker

- Revenue sharing agreement with the Looping Collective for the launch of an external HYPE liquid locker

- Start discussion with exchanges regarding potential listing of SDT

Financials

Stake DAO treasury : DeBank | Your go-to portfolio tracker for Ethereum and EVM

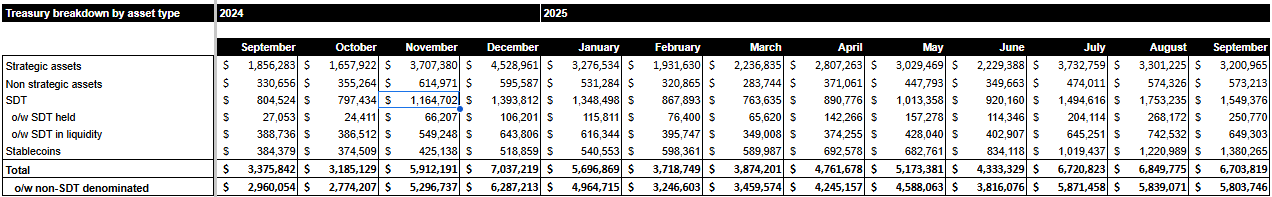

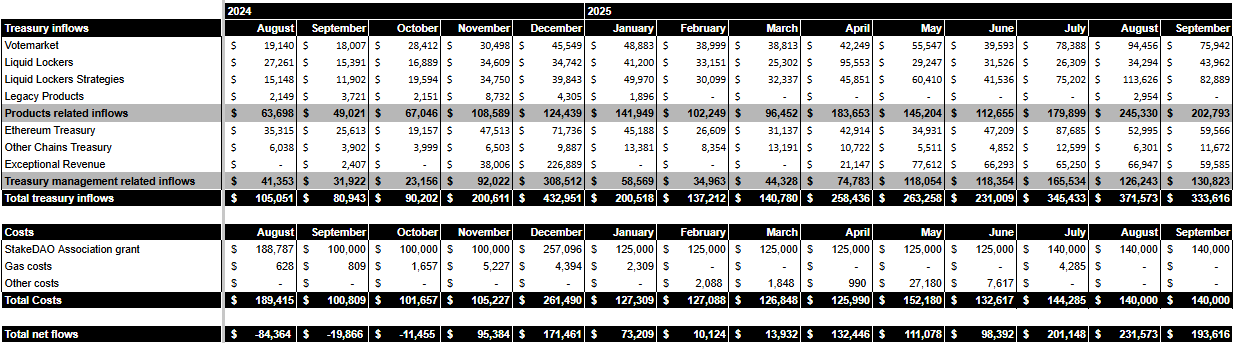

Strong fee generation offset the negative impact of the market downturn in September.

Net treasury cash flows

Stake DAO’s migration towards v2 on mainnet led to an approximate one-week loss of rewards which was expected and couldn’t be avoided, explaining a large chunk of the drop of strategies’ fees. Other reasons include the fact that August included one week of July fees for side-chain strategies, and more importantly, the impact of CRV continued down trend in September.

Exceptional revenue include an exceptional loss of $23k linked to the TAC vote incentive deal, which was offset by the CAKE price increase which happened in early October.

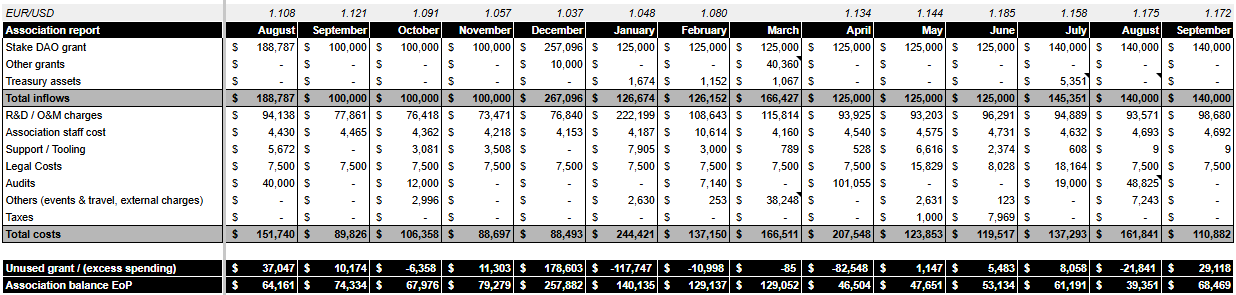

Association grant use report

No exceptional costs this month, leading to an unspent grant of $29k.

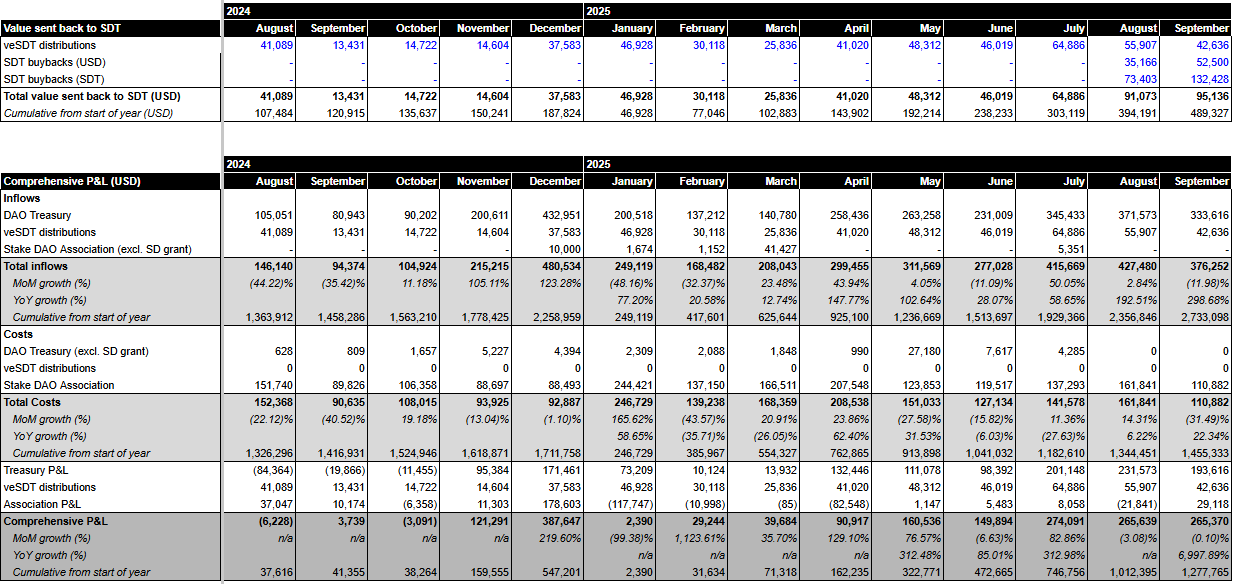

Comprehensive view

Comprehensive net inflow in line with the August performance on the back of lower inflows and lower costs.

In September again, nearly $100k of value has been sent back to SDT holders through veSDT distribution (lower than than in August due to the Staking v2 migration), and higher buybacks, as Stake DAO treasury acquired 132,428 SDT at an average price of $0.396

Legal & governance

September retrospective

- Stake DAO voted to launch a curation vertical

- Twitter account has been safely transitioned to Stake DAO Association

Focus for October

- Proposal regarding the migration of Vote Bounty Manager contracts

- Transfer of the Stake DAO LinkedIn account and missing legacy Foundation funds to Stake DAO Association

Disclaimer

The Stake DAO Association acts strictly in an execution-only capacity, pursuant to mandates adopted by the DAO through governance processes. The Association does not provide investment advice, does not engage in asset management on its own account, and assumes no ownership or custody over DAO treasury assets. Any contracts, payments, or services facilitated by the Association are executed solely as administrative and operational support for the DAO, and shall not be construed as creating legal or financial liability of the Association beyond such execution. The Association expressly disclaims succession to any past entity or foundation, and no assumption of legacy liabilities is intended or implied.