Highlights

- Second audit successfully passed for new staking infrastructure

- Strong development of the Curve LP footprint

- Yieldnest pre-launch locker deployed

Product (Strategy/Smart contracts/UI/Development)

May retrospective

- Staking v2 passed the second audit, fixes done and reviewed

- Staking v2 UI ready to be shipped

- Created a pre-launch locker factory

- Shipped the YieldNest pre-launch locker

- vlCVX votes on veFXN VMv2

- Deployed a manager hook on Votemarket v2 to allow unused incentives to be sent back to the manager

- Adjusted sdPENDLE rewards from WETH to USDC (to adapt to the recent Pendle reward distribution update)

- Enacted SDGP-53 and 54

- Several UI/UX improvements

Focus for June

- Shipping Staking v2

- Yieldnest locker fully launched

- asdYND shipped and bridged to BNB Chain

- Deciding on a curation infrastructure provider

- Creating a standard collaboration framework with Merkl to deploy boosted strategies on for projects using Merkl distribution (Zerolend, YieldNest and Spectra so far)

Business development

May retrospective

In a more favourable market environment, May marked the third month of very successful growth on the strategies side for Stake DAO.

- Secured a partnership with TAC to give privileged access to TAC farms via Stake DAO

- The sdBAL locker also grew by >10%, exceeding 330k veBAL and reaching 6% of the total veBAL supply

- asdPENDLE reached 175k sdPENDLE, while sdPENDLE regained full peg

- sdCRV is still depegged, but showing strength compared to other wrappers (notably cvxCRV struggling around 45% peg)

- Stake DAO strategies saw a huge growth this month, claiming back the $100m mark for the first time since 2022:

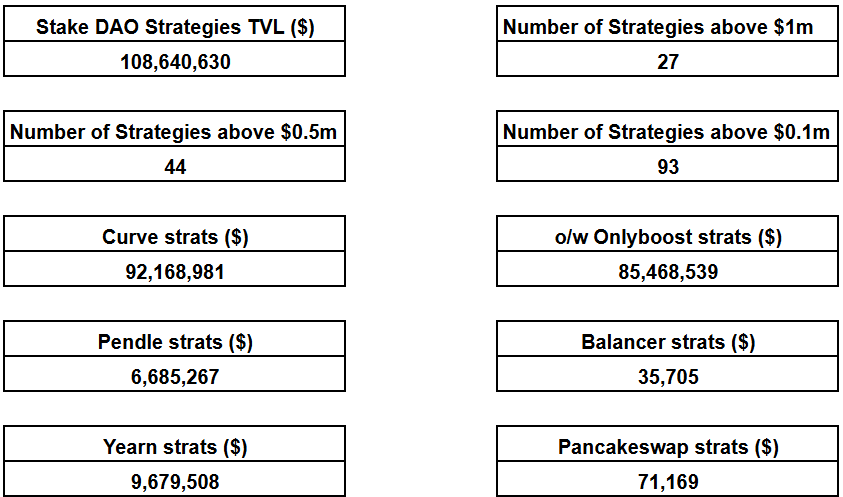

- Total TVL in strategies: $108.6m (+$31m / +41% MoM)

- Onlyboost TVL: $85.5m (+$27.3m / +47% MoM)

- Share of CRV emissions going through Stake DAO strategies: 12.7% (ATH)

- Number of strategies above $1m: 27 (+7 / +35% MoM)

- Number of strategies above $0.1m: 93 (+5 / +6% MoM)

- Yearn strategies’ TVL: $9.6m (+$2.3m / +32% MoM)

- Pendle strategies’ TVL: $6.7m (+$2.3m / +51% MoM)

Focus for June

- Staking v2 migration and marketing

- Push the YND locker

- Push the tacTKN strategies and bribes

Financials

Stake DAO treasury : DeBank | Your go-to portfolio tracker for Ethereum and EVM

ETH’s performance and solid earnings generation had a positive impact on Stake DAO’s treasury in May, with a total treasury reaching $5.2m from $4.8m..

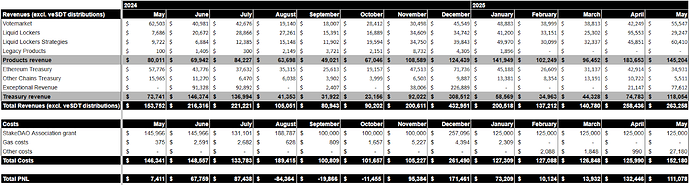

P&L

The DAO generated strong earnings this month, with a 33% growth on Strategies revenues, some exceptional earnings coming from the sdCAKE redemption which is CAKE denominated, and benefiting from the solid CAKE/USD performance. The lower than usual performance of the Ethereum treasury is explained by a large vote bounty that was depositted on an opportunistic basis for the SDT/ETH pool, as the bribe efficiency was quite high (around 2x). The benefit of this bounty deposit will be visible in June.

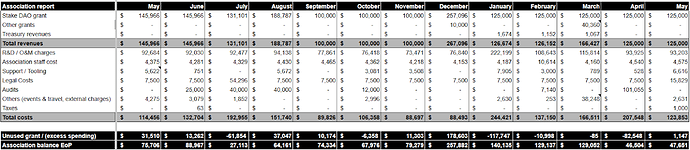

Association grant use report

In May, the costs of the Association were fully covered by the grant. It included .

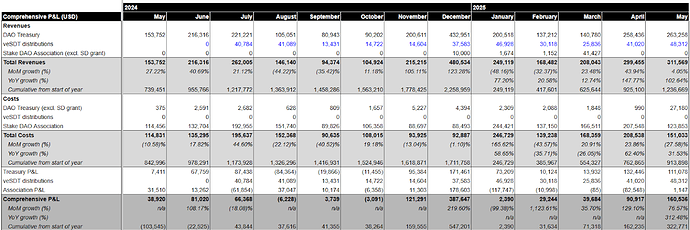

Comprehensive view

Earnings grew by 5% in May despite the exceptional Angle-denominated earning in April. Costs went down by 28% as there were no audit costs in May. Distributions to veSDT reached an ATH at $48k. Overall, the business generated $311k of earnings and $160k of profits, excluding any price impact on treasury assets. The cumulative earnings and profits for 2025 reached respectively $1.2m and $322k.

Legal & governance

May retrospective

- sdTKN liquidity scaling proposal

- Whitelisting of Bent multisig

Focus for June

- Accepting ownership and migration of strategies towards Staking v2

- vlSDT migration proposal

- Hypernative integration proposal

- Transfer of socials’ accounts and missing legacy Foundation funds to Stake DAO Association