Highlights

- Zerolend locker finished with the new locker infrastructure

- Challenging market environment stressed the DAO’s revenues

- 1m vlCVX votes delegated

Product (Strategy/Smart contracts/UI/Development)

February retrospective

- Staking v2 development started

- L2 rewards management for Votemarket

- Resolv points integration

- API for data management finished (current data)

Focus for March

- Zerolend locker UI shipped

- Develop the SPECTRA and Yieldnest lockers

- Staking v2 ready for audit

- Balancer VMv2

- Specific page for vlCVX vote delegation, enabling reward forwarding for Votium bribes

Business development

February retrospective

- Stake DAO was awarded a grant by Morpho (25k MORPHO)

- New vlCVX vote delegation bringing an additional 700k votes to the delegation

- Partnership with Resolv for three yield strategies brought ~$4m in TVL on high yielding strategies

- ATH share of Curve inflation going through Stake DAO strategies, notably driven by a BD push on the new USR strategies (GHO/USR and DOLA/USR): 11.30% (+60bps MoM)

- sdPENDLE repegged and started locking again

- Sharp increase in Pendle strategies TVL (Resolv marketing program and repeg bringing attention to SD’s Pendle locker)

- Huge market drop led to a decrease in TVL for Stake DAO’s strategies:

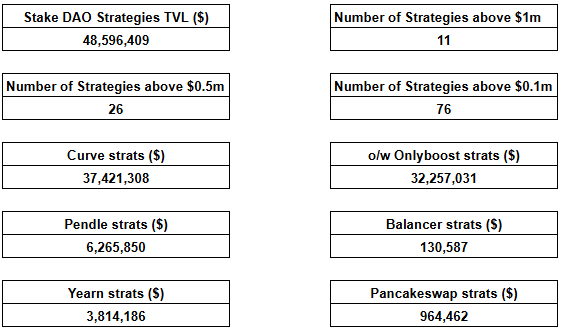

- Total TVL in strategies: $48.6m (-$5.5m / -10% MoM)

- Onlyboost TVL: $32m (-$6m / -15% MoM)

- Number of strategies above $1m: 10 (+1 / +10% MoM)

- Number of strategies above $0.1m: 76 (+13 / +20% MoM)

- Pendle strategies TVL: $6.3m (+$2.2m / +54% MoM)

- 23% of Stake DAO strategies TVL doesn’t come from Curve

Focus for March

- Prepare the ZeroLend locker launch

- Start the work on Tetu boost delegation

- Study new partnerships like the Resolv one

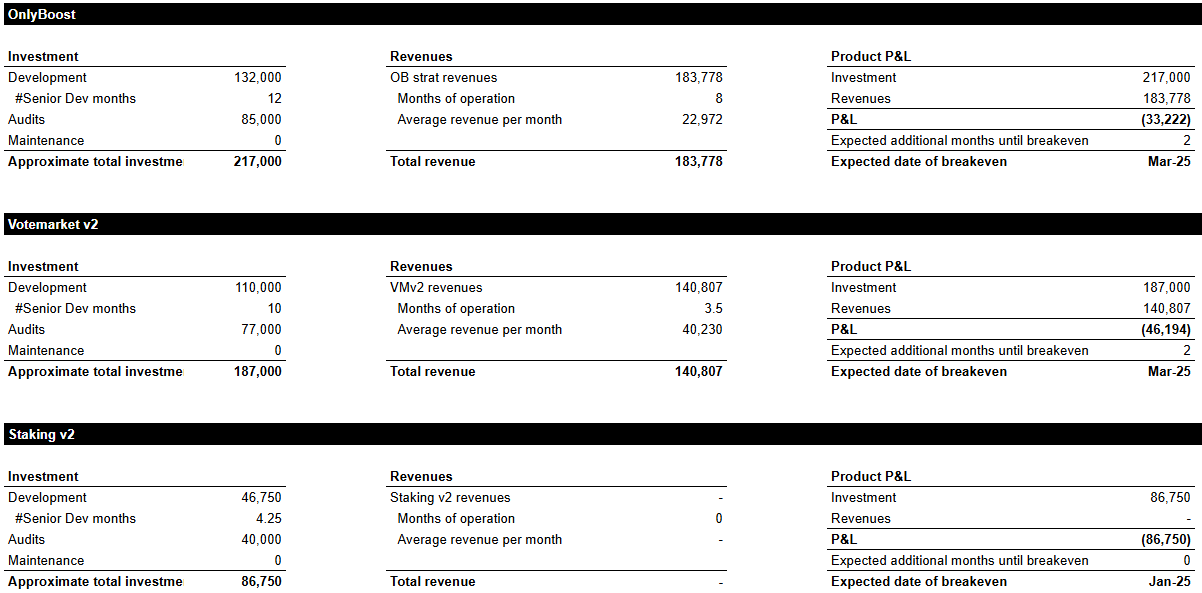

Product investment performance tracking

Financials

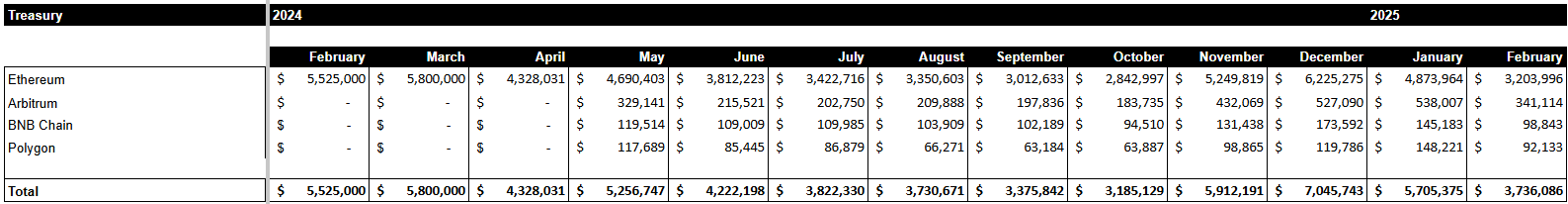

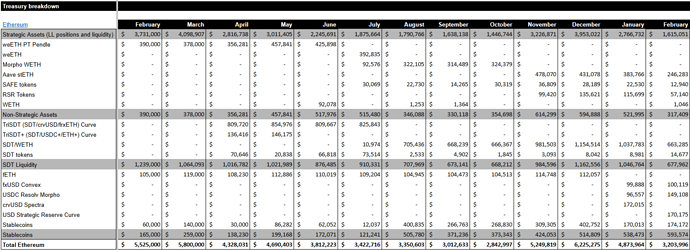

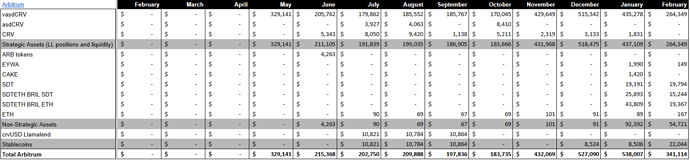

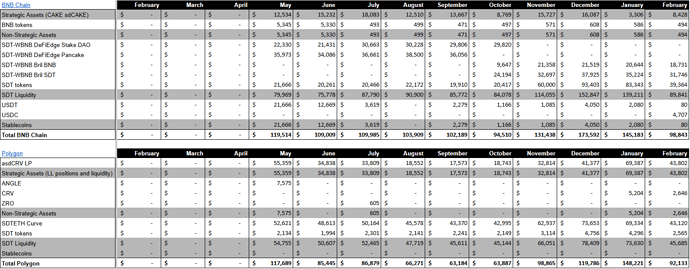

Stake DAO treasury : https://debank.com/profile/0xf930ebbd05ef8b25b1797b9b2109ddc9b0d43063

The treasury saw a steep decrease this month following the market downturn.

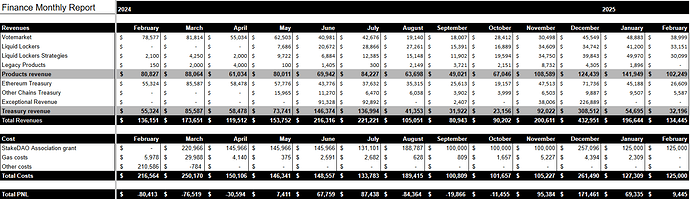

P&L

Market downturn hit our revenues this month. Our TVL broadly remained stable/increased in token amounts, but decreased in $ value, while yields also went down. This put pressure on the DAO revenues which only saw a $9k profit this month. It’s still positive to see that the DAO is able to serve its costs in stressed markets such as this one.

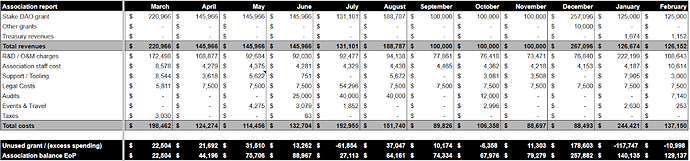

Association grant use report

Some exceptional spending (c.$40k) explain the over spending this month on the Association’s side. Overall, adding the DAO’s PNL and the Association’s excess spending, we see a $1.5k deficit of the activity in February, acknowledging there were $40k of exceptional spending.

Legal & governance

February retrospective

- Bent multisig whitelist

- Annual general assembly of the Association

- 2024 retrospective community call

Focus for March

- sdANGLE unlock proposal

- Very old WBTC claim deadline proposal